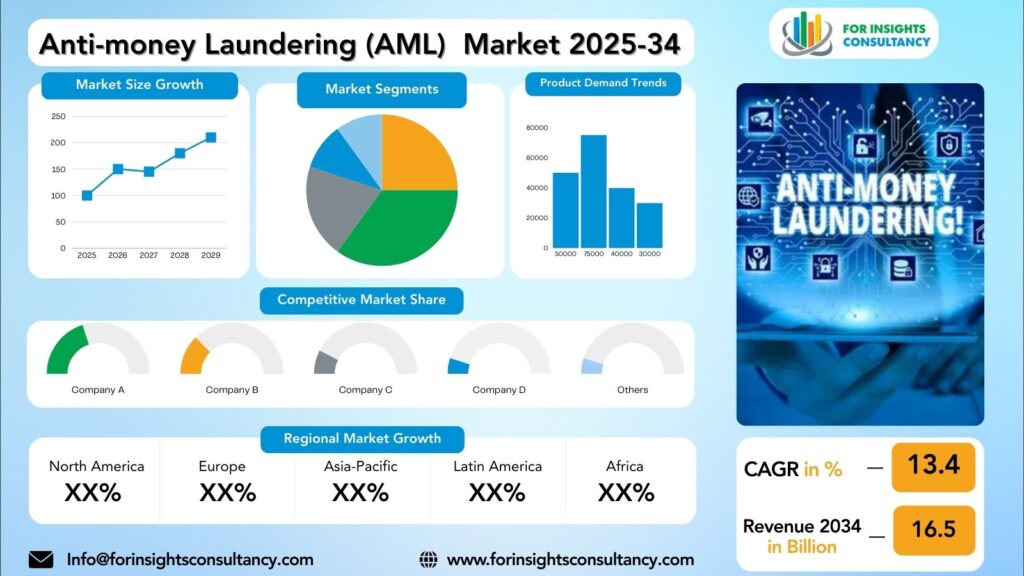

Anti-money Laundering (AML) Market Research Report by Metal Component / Offering (Software, Services), by Product / Solution Type (Transaction Monitoring, Customer Identity Management (CIM) / Know Your Customer (KYC), Compliance Management, Case Management & Reporting) and, by Deployment Mode (On-Premises, Cloud-Based), by Enterprise Size (Large Enterprises, Small and Medium-Sized Enterprises (SMEs)), And by Region- Global Forecast to 2034

Aug-2025 Formats | PDF | Category: IT | Delivery: 24 to 72 Hours

Anti-money Laundering (AML) Market is forecast to increase from USD 4.9 billion in 2025 to USD 13.4 billion by 2034, at a CAGR of 16.5%.

Anti-money Laundering (AML) Market: A Comprehensive Overview

The anti-money laundering market comprises a wide variety of products and services designed to aid banks and financial institutions, as well as different organizations to identify and stop the flow of money from illegal sources. Usually, These solutions are equipped with cutting-edge technologies such as those powered by machine learning tech and AI that assist in automatically sifting through mountains of transactions in search of money laundering related activities. After executing one or each of those technologies, enterprises will lessen their exposure to being used as vehicles for money laundering and other shady dealings.

The AML market is growing due to many factors. The pivotal factor here could be the tightening of regulations globally. Regulators have consistently increased their focus on combating money laundering and terrorist financing issues, which has boosted the demand for AML solutions among many organizations. Likewise, the rise of digital banking and online payments has provided money launderers with new ways to operate, so companies are compelled to search for highly efficient AML solutions to integrate into their practices.

The consensus among industry experts is that the AML market will be undergoing explosive growth a year down the road. As financial institutions keep on receiving regulatory pressure, demand for anti-money laundering solutions will be going only upwards. Besides that, the nature of the mules’ methods is constantly changing Besides that, the convoluted financial transactions with mules are getting more complicated Also, Safety needs become more stringent because of the utilization of technology Finally, on the whole, the market for anti-money laundering solutions is forecasted to grow like wildfire in the near future.

The anti-money laundering (AML) market is mostly controlled by several main players who offer a vast array of solutions and services geared towards the fight against financial crime. These firms are usually tech-based and are involved in the solution design part of the new frontier technologies that aim to fight and detect money laundering. Some of the foremost companies setting the direction of the AML technology evolution include SAS Institute, ACI Worldwide, FICO, and Oracle. Leveraging their pioneering work in the AML arena, these juggernauts are vital in helping enterprises ahead of the ever-changing risks.

It is true, the anti-money laundering (AML) industry represents a grand opportunity for escalation however it is not without ceaseless challenges adrift in uncharted waters. Among those challenges is the relentless evolution of money laundering tactics that awaits firms operating in this arena. Offenders are always engineering methods by which they evade the anti-money laundering regulations thus posing a never-ending threat against financial institutions and the rest of the organizations. Yet firms with the right combination of technology and proficiency will be successful in overcoming this challenge and halting illegal money laundering operations.

To sum up, The AML market is very likely going to witness an upsurge of significant magnitude throughout the next year. An increase in demand for refined anti-money laundering (AML) solutions will accompany the surge in regulatory pressures as well as the continuous evolution of money laundering risks. If companies want to lessen the risks of financial criminal activities and still safeguard their businesses from becoming accomplices, they need to be ahead of the game and also invest in top-notch technologies. Ample room exists in the near future for AML market progress through both creative ideas and expansion possibilities.

Anti-money Laundering (AML) Market Dynamics

Growth Drivers

Strict Regulatory Mandates: Governments and other authorities are enacting stricter AML regulations on financial institutions with higher transparency and as a deterrent against money laundering.

Arriving Technology: Developments in technology such as artificial intelligence and machine learning will allow financial institutions to obtain refined AML solutions which can process more amounts of data to identify suspicious activity.

Increased Financial Crimes: Increased instances of financial crimes, including but not limited to, fraud and terrorism funding, require AML solutions to help financial institutions identify and mitigate illicit activity.

Restraint

The AML market is facing a significant limitation with the high cost of compliance solutions, particularly for small and medium-sized businesses that do not have the resources available to comply with the evolving regulatory landscape. The AML regulatory environment is constantly changing, can be extremely complex, and will require ongoing monitoring and reporting by organizations, which can complicate compliance, increase risk, and lead to compliance gaps.

Technology can play an important role in helping businesses overcome the barriers in the AML marketplace. Technologies such as advanced analytics and artificial intelligence (AI) solutions can help businesses automate the compliance process, reduce manual work, and improve accuracy, especially in transaction monitoring processes. For organizations, using the best technology will help to better manage AML competencies, achieve operational efficiencies, and stay on top of AML regulatory requirements.

Opportunity

While many of the impediments presented by regulatory restrictions have limits, even the AML market, which often operates in a highly restrictive environment, poses significant opportunities for growth and innovation. With the growing acceptance of digital worlds and payments, the growth of cryptocurrency, and the hosting of crypto in places that require less stringent regulation has also created ample opportunities for the laundering of money which all created demand for more complex and “smart” AML solutions. Companies able and willing to evolve with these complex environments and to provide integrated and complex services in order to affect meaningful AML services, will have a competitive advantage and be the most relevant directly and indirectly to risk within the industry.

Utilization of Data – Life Force

Data is the lifeblood of AML compliance. Data gives organizations the capability to identify suspicious activities, analyze outcomes, and mitigate risks. If organizations can take advantage of big data as well as analytics, they can find insights that were once hidden; identify potential threats; and build onto their level of AML capabilities. Companies understanding how to leverage their data; having strategic plans; and the right resources with data as the focus; can enhance their compliance obligations, protect their properties and intellectual property, and protect their identity within the market.

Challenges

These potential growth prospects are presently being hindered by various market challenges in the AML space. These specific challenges include:

Regulatory Landscape Complexity: The regulatory environment surrounding AML is complex and dynamic; fin-techs are troubled by the myriad of AML regulations that are in constant flux across multiple jurisdictions.

Changing Technologies: Criminal enterprises are constantly changing their money laundering behaviours and methods, making it difficult for AML solutions to remain effective.

Costly: Keeping a largely ineffective AML solution and only then implementing and maintaining an effective AML program is a high financial burden for financial institutions to absorb, particularly small firms that are resource constrained.

Anti-money Laundering (AML) Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- TransUnion

- ComplyAdvantage

- FRISS

- Nelito Systems

- Comarch

- Alldigi Tech

- Dixtior

- Temenos

- TCS

- Featurespace

- Feedzai

- LexisNexis

- Oracle

- FIS

- Fiserv

- Jumio

- NICE Actimize

- SAS Institute

- GB Group PLC

- FICO

- ACI Worldwide

- Experian

- Wolters Kluwer

Anti-money Laundering (AML) Market News

May 13, 2025 New Oracle Cloud Service Enables Smarter, Faster Anti-Money Laundering Compliance Process for Financial Institutions

Oracle today announced the Oracle Financial Crime and Compliance Management Automated Scenario Calibration (ASC) Cloud Service, which transforms monitoring of anti-money laundering (AML) transactions by automating the manual process of scenario tuning. AML scenarios are designed to detect and prevent money laundering, terrorist financing, and other financial crimes. Available globally, the new automation service enables financial institutions’ compliance teams to improve efficiency, expedite regulatory requirements, and reduce operational costs.

05/07/2024 LexisNexis Risk Solutions Ranked as Category Leader in AML Transaction Monitoring Solutions Report by Chartis Research

ATLANTA — LexisNexis® Risk Solutions has earned a place in the Category Leaders quadrant by Chartis Research in its Market Quadrant for AML Transaction Monitoring Solutions, 2023 report. LexisNexis Risk Solutions ranked Best in Class for data and systems integrations and rated its risk typology modeling and solution and packaging deployment as industry leading. In its report that evaluated 25 anti-money laundering solution providers, Chartis recognized LexisNexis Risk Solutions for its advanced capabilities of products in model quality and validation, as well as workflow automation.

07/07/2025 MAS reprimanded nine firms & 18 Individuals for AML breaches following a 2023 Money laundering case

The Monetary Authority of Singapore (MAS) announced its regulatory actions against nine financial institutions (FIs) and several individuals for breaches related to anti-money laundering. MAS has completed its supervisory examinations against pertinent FIs with nexus to persons of interest (POIs) in the significant money laundering (ML) case of August 2023, and their employees who fell short of MAS’ Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) requirements.

Segmented View of the Industry:

The Anti-money Laundering (AML) Market Is Mapped Through A Multidimensional Lens-Tracking Shifts Across Product Type, Applications, And Geographic Regions. This Segmented Approach Enables Businesses To Localize Their Growth Plans And Align Offerings With The Most Profitable Demand Centers.

Segmentation By Component / Offering

- Software

- Services

- Professional Services

- Managed Services

Segmentation By Product / Solution Type

- Transaction Monitoring

- Customer Identity Management (CIM) / Know Your Customer (KYC)

- Compliance Management

- Case Management & Reporting

Segmentation By Deployment Mode

- On-Premises

- Cloud-Based

Segmentation By Enterprise Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

Segmentation by End User

- Banking, Financial Services, and Insurance (BFSI)

- Government & Public Sector

- IT & Telecommunications

- Healthcare

- Other Industries

Global Geographic Coverage:

The Report Provides In-Depth Qualitative and Quantitative Data On The Anti-money Laundering (AML) Market For All Of The Regions And Countries Listed Below:

North America

US:

The US has effectively been in the lead of implementing strict AML regulations. The US issue is would be led by the Financial Crimes Enforcement Network as it is for financial institutions in the US to know and abide by strict Know Your Customer (KYC) and Customer Due Diligence procedures. Due to the strictness of the regulatory environment, there has been an increase in AML solutions in demand including transaction monitoring, risk assessment, and reporting compliance.

Canada:

Financial Transactions and Reports Analysis Centre of Canada effectively leads AML policies in Canada where they oversee the standards of the Proceeds of Crime (Money Laundering) and Terrorist Financing Act. Canadian financial institutions also have the issue of ongoing customer transaction monitoring and also have to report suspicious activity to FINTRAC. Thanks to the ongoing monetary issue with respect to AML policies, there has been a strong market for more sophisticated approaches to detect and stop money laundering in Canada.

Mexico:

Verbiage issue is that the financial intelligence unit would lead it with respect to its regulatory regime of the country. Mexico with respect to the US and Canada, also has a strong use of digital payments and cross border transactions, which lead to the evolving complexity around the AML landscape in Mexico, making Mexican financial institutions to ensure, with respect to the evolving complexity of AML landscape, to invest in more robust/ advanced AML solutions to continue to detect fraud that is going on within the regulatory requirements.

Europe

United Kingdom:

As one of the world’s greatest financial centers, the UK has been making improvements to its AML framework. The UK’s Financial Conduct Authority (FCA) plays an important role to regulate financial institutions as well as enforcing AML rules. Below, I display the UK implementation of the 5th Anti-Money Laundering Directive in alignment with EU standards:

Germany:

Germany also has a strong banking sector and has taken measures to prevent or protect from illicit financial activities through anti-money-laundering measures. The Federal Financial Supervisory Authority (BaFin) is responsible for monitoring financial compliance in Germany and works similarly as the FCA in relation to AML compliance among financial institutions. Germany’s involvement in AML-related schemes has continued to improve the integrity of its banking system.

France:

France has taken many steps in order to prevent money laundering in recent years. The Tracfin unit is dedicated to developing measures in order to analyze and combat illicit financial activities. France can be actively involved in AML related measures within the European Union which will include implementation of regulations and directives related to financial services including AML regulations. France continues to strengthen its AML measures to detect and inhibit financial crime.

In Italy:

In Italy, the Financial Intelligence Unit (UIF) is central to efforts to prevent money laundering and terrorist financing. Italy has further strengthened its existing Anti-Money Laundering (AML) laws to address new dynamics in the financial system. Italy’s proactive emphasis of regulating AML highlights its commitment to protect the integrity of the financial sector.

In Spain:

Spain has made progress in strengthening its AML regulations in the recent years to address the vulnerabilities of money laundering. The Spanish Anti-Money Laundering Commission is in charge of setting and overseeing AML policy and also works in conjunction with financial institutions to enforce compliance. Spain’s proactive stance on AML regulation is indicative of willingness to safeguard its financial system from financial crime.

Asia Pacific

The Asia Pacific region is a major contributor to the global AML market, with countries such as China, Japan, and India taking a lot of actions to address financial crimes. As the second largest economy in the world, China has invested heavily into AML technologies and regulations as a means of enhancing its financial system. Conversely, Japan has acted to create absolute laws to inhibit money laundering. Lastly, India, as a fast growing economy, has been focusing on enhancing its AML capacity to deter financial crimes.

China

In recent years, China has ramped up its efforts to prevent money laundering and terrorist financing. The country has developed a regulatory regime with laws like the Anti-money Laundering Law, and the Counter-Terrorism Financing Law. Entities in the financial system are required to develop policies and procedures to implement effective AML programs and conduct customer due diligence to ensure that there are no suspicious transactions. China has also made a big push towards increasing its AML capabilities in the digital environment, in line with the increased number of digital financial services that are occurring.

Japan

Japan has one of the strictest AML regimes in the world, receiving continual praise from the Financial Action Task Force (FATF) for its treatment regarding the prevention of financial criminology. Japanese financial institutions must comply with a rigorous regime of AML laws, conduct customer due diligence, and report suspicious transactions to the authorities. Japan is also a pioneer in using technology to improve its AML capabilities.

India

In India, efforts to develop an AML framework and prevent money laundering activities have been proactive by the Government. The Prevention of Money Laundering Act and the new Financial Intelligence Unit-India are two non-mutual laws that together combat financial crime in India. Indian financial institutions must implement effective AML programs that include KYC checks done on customers and must report suspicious transaction reports (STR) to the authorities. Finally, with the rise in digital transactions, India will be concentrating on using technology to implement AML solutions to build its capabilities.

Middle East and Africa

United Arab Emirates (UAE)

The UAE is making great strides to enhance AML regulation and combat financial crime. The FIU plays a pivotal role in delivering improved coordination with authorities to prevent money laundering and terrorist financing. Having the regulatory architecture in place, the UAE has grown into a serious player in global AML.

Saudi Arabia

Saudi Arabia has also been improving its AML regulations to align with the international standards. The FATF has recognized Saudi Arabia’s work in combatting money laundering and terrorist financing. Financial institutions in Saudi Arabia are increasingly adopting new technologies around AML practices to produce better compliance processes.

South Africa

South Africa has made major advancements to enhance its AML regulations to combat financial crime. The FIC is the major player in the country collecting financial intelligence and analyzing that financial intelligence to detect and combat money laundering. South Africa’s AML market is in the growth phase, driven by increasing regulatory requirements and technology enhancements.

Africa

Kenya

Kenya is actively enhancing its AML legislation to combat financial crime. The Financial Reporting Centre (FRC) is fundamental in collecting, analyzing, and disseminating financial intelligence. As the country focuses on regulatory compliance, it is projected that the AML market will grow in the near future.

Egypt

Egypt has been taking strides to enhance its AML regulations to combat money laundering and has been increasing its capacity. The Money Laundering Combating Unit (MLCU) collaborates with various international organizations to strengthen Egypt’s AML capabilities. Additionally, the AML market is expected to grow due to expanding regulatory frameworks and technology advancements.

Reasons to Buy:

- The Research Would Help Top Administration/Policymakers/Professionals/Product Advancements/Sales Managers And Stakeholders In This Market In The Following Ways.

- The Report Provides Anti-money Laundering (AML) Market Revenues At The Worldwide, Regional, And Country Levels With A Complete Analysis To 2034 Permitting Companies To Analyze Their Market Share And Analyze Projections, And Find New Markets To Aim For.

- To Understand The Most Affecting Driving And Restraining Forces In The Market And Their Impact On The Global Market.

- Major Changes And Assessment In Market Dynamics And Developments.

- The Objective Of The Anti-money Laundering (AML) Market Report Is To Identify New Business Opportunities Using Quantitative Market Forecasts.

- Formulate Sales And Marketing Strategies By Gaining An Understanding Of Competitors, Their Positioning, And Strengths & Weaknesses.

Faq – What Global Leaders Are Asking

What Is The Growth Prospect For The Anti-money Laundering (AML) Market By 2034?

Anti-money Laundering (AML) Market Is Expected To Achieve A Stable Growth Rate With A Compound Annual Growth Rate (Cagr) Of About 16.5% From 2025 Through 2034.

What Is Driving The Growth Of The Anti-money Laundering (AML) Market?

The Anti-money Laundering (AML) market’s growth is driven by increasingly stringent global regulations and a surge in financial crimes. The rapid adoption of digital payments, online banking, and cryptocurrencies has created a need for advanced, AI-powered solutions to monitor complex transactions and combat illicit activities.

Who Are The Key Players In The Anti-money Laundering (AML) Market, And What Are Their Market Shares?

The Anti-money Laundering (AML) Market Includes Major Companies Like TransUnion, ComplyAdvantage, FRISS, Nelito Systems, Comarch, Alldigi Tech, Dixtior, Temenos, TCS, Featurespace, Feedzai, LexisNexis, Oracle, FIS, Fiserv, Jumio, NICE Actimize, SAS Institute, GB Group PLC, FICO, ACI Worldwide, Experian, Wolters Kluwer.

Specific Market Share Data Is Not Publicly Available And Is Typically Provided In Detailed, Proprietary Market Research Reports.

Which Regions Are Leading The Anti-money Laundering (AML) Market Growth?

North America leads the Anti-money Laundering (AML) market, driven by its stringent regulatory environment and the strong enforcement of financial crime laws. The Asia-Pacific region is the fastest-growing market, due to rapid digitization and government initiatives to combat financial crime.

Customization: We Can Provide Following Things

1) On Market More Company Profiles (Competitors)

2) Data About Particular Country Or Region

3) We Will Incorporate The Same With No Additional Cost (Post Conducting Feasibility).

Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us/

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/