ePayment System Market Size, Trends Analysis Research Report By Component/Solution (Payment Gateway Solutions, Payment Processing Solutions, Payment Wallet/Mobile Wallet Solutions, Point of Sale (POS) Solutions, Payment Security & Fraud Management), by Payment Mode (Credit Cards, Debit & Other Cards, E-Wallet/Digital Wallet, Bank Transfer (ACH, Wire), Cash on Delivery (COD)), by End-Use Industry, and By Region Global Market Analysis And Forecast, 2025-2034

Oct-2025 Formats | PDF | Category: IT | Delivery: 24 to 72 Hours

The report highlights that the market outlook is significantly influenced by swift shifts in global trade relations and tariffs. It emphasizes the necessity of updating the report before delivery to incorporate the most current status, which includes revised market forecasts and a comprehensive analysis of the quantified impacts of these changes.

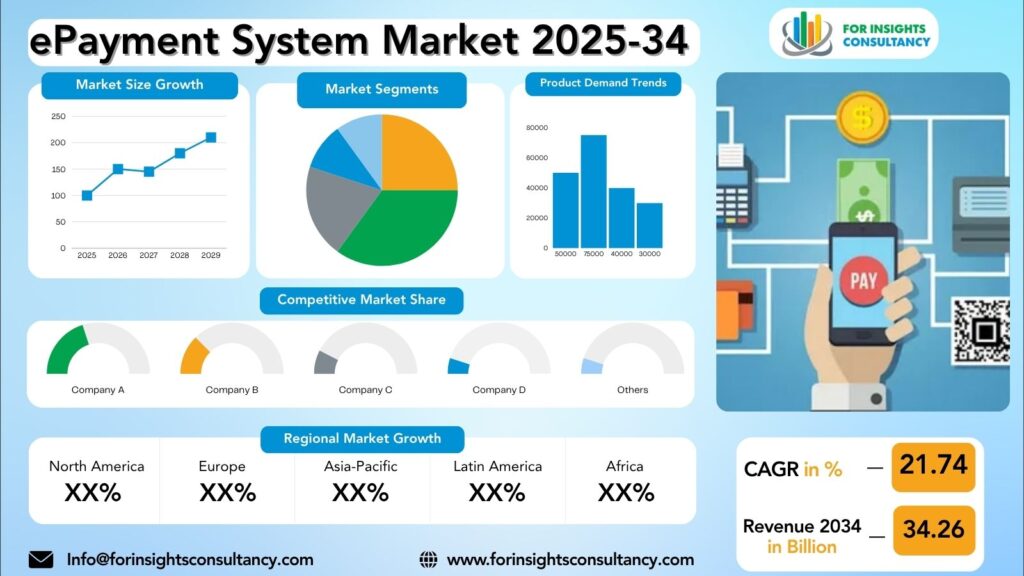

ePayment System Market Is Forecast to Increase from USD 148.72 Billion In 2025 To USD 534.26 Billion By 2034, At A CAGR Of 21.74%.

ePayment System Market: A Comprehensive Overview and Future Developments

The ePayment System Market is experiencing substantial growth, driven by the global adoption of digital payment methods as consumers increasingly prefer cashless transactions. Businesses are actively seeking secure and convenient ePayment solutions to meet these evolving customer preferences. This market is marked by the rise of innovative technologies such as mobile wallets, contactless payments, and biometric authentication, all of which enhance transaction security and enable seamless user experiences.

Looking to the future, key developments in the ePayment System Market are poised to emphasize improvements in user experience, enhancements to cybersecurity protocols, and efforts to promote financial inclusion. The anticipated integration of cutting-edge technologies like artificial intelligence and blockchain is expected to transform the ePayment landscape, facilitating more personalized services and robust security features. Moreover, as the market continues to adapt, partnerships among fintech companies, banking institutions, and regulatory bodies will be instrumental in guiding the evolution of ePayment systems, ensuring that they align with consumer needs and technological advancements.

Market Insights

North America consistently holds the largest revenue share in the digital payment market, with various reports estimating its share in 2024 to be between 36.8% of the global market. While North America currently holds the largest share, the Asia-Pacific region is frequently cited as the fastest-growing market.

For 2024, the percentage of the U.S. population residing in urban areas is estimated to be approximately 82.5%. The World Bank reported the urban population in the United States as 83.48% of the total population in 2024.

Largest Revenue Share Segment – Solutions (Gateway, Processing, Wallet, etc.) / Payment Processing-Approximately 25.7% to 63.3% (depending on inclusion of all solutions or just processing), Point of Sale (PoS)- 57.4%, Retail and E-commerce or BFSI (Banking, Financial Services, and Insurance)- 24%, Large Enterprises- 59.8%

AI Impact

The ePayment System Market is currently undergoing a transformative change due to the incorporation of artificial intelligence (AI) technologies. Businesses are increasingly utilizing AI to enhance security measures, refine user experiences, and streamline payment operations. In particular, AI algorithms play a crucial role in the real-time detection and prevention of fraudulent transactions, thereby ensuring more secure electronic payments. Furthermore, AI-driven chatbots and virtual assistants are being deployed to deliver personalized, efficient customer support, which significantly enhances the overall payment experience for users. As a result of these innovations, ePayment systems are evolving to become more intelligent and adaptive, contributing to higher transaction accuracy and expedited processing times. The prospects for the ePayment System Market suggest considerable potential for ongoing innovation and expansion, solidly rooted in the advancements of AI technology.

Market Dynamics

Trends

The ePayment System Market is currently experiencing several key trends that are significantly impacting its growth. One of the most notable trends is the increasing adoption of mobile payments, largely driven by the widespread use of smartphones, which offer users the convenience of conducting transactions while on-the-go. Additionally, the popularity of contactless payments has surged, primarily influenced by the demand for more hygienic and efficient payment options in the wake of the COVID-19 pandemic.

The landscape of ePayments is also being transformed by the integration of advanced technologies such as biometric authentication, blockchain, and artificial intelligence. These innovations are enhancing security measures and improving the overall user experience. Furthermore, the rise of digital wallets and peer-to-peer payment platforms is fostering innovation within the market, granting consumers a broader range of options for managing their finances in a seamless manner.

In summary, the trends identified reflect a dynamic and rapidly evolving ePayment System Market, poised for continuous transformation and expansion as it adapts to changing consumer needs and technological advancements.

Growth Drivers

The ePayment System Market is experiencing notable expansion attributed to several critical factors. A primary driver is the increasing adoption of digital payment solutions among both businesses and consumers, which enhances convenience, security, and speed, thereby attracting a broader user base. Furthermore, the widespread availability of smartphones and enhanced internet connectivity have made ePayment systems more accessible to previously underserved demographics. The growing trend of online shopping and e-commerce continues to elevate the demand for effective and reliable electronic payment solutions. Consequently, the ePayment System Market is projected to persist in its growth trajectory in the coming years, supported by innovative technologies and strategic partnerships that will further stimulate its development.

Restraints

Restraints in the ePayment System Market encompass various challenges that impede the acceptance and development of electronic payment solutions. Key barriers include significant security concerns, such as vulnerabilities to data breaches and fraud, which create hesitance among consumers and businesses alike. Additionally, the lack of standardization and interoperability among disparate payment systems complicates the seamless integration and usage of these electronic solutions. Resistance to transitioning from established traditional payment methods further exacerbates the situation, as many stakeholders are reluctant to adopt new systems. Regulatory hurdles and compliance intricacies present additional obstacles, creating a complex landscape that must be navigated to achieve wider acceptance. Moreover, access to digital financial services remains limited in specific regions, restricting the potential user base and stunting market growth.

Addressing these restraints is crucial for the advancement of the ePayment system. Strategies such as fostering innovation, enhancing collaboration among stakeholders, and ensuring robust regulatory frameworks are essential for overcoming these challenges. These efforts will be vital in unlocking the full potential of the ePayment System Market and facilitating its future growth.

Opportunities

The ePayment System Market is experiencing substantial growth, providing numerous opportunities across diverse industries. The shift towards digital payments enables businesses to optimize their payment processes, enhance customer experiences, and boost operational efficiency. This surge in demand for secure and user-friendly payment options is fuelling innovation in ePayment technologies, including mobile wallets, contactless payments, and blockchain-based solutions. Furthermore, the booming e-commerce sector is propelling the adoption of ePayment systems, opening new pathways for revenue generation and enhancing customer engagement. Companies that integrate ePayment systems are positioned to remain competitive in the rapidly evolving digital economy, thus harnessing the extensive opportunities attributable to the dynamic payment landscape.

Challenges

In the ePayment System Market, businesses encounter several critical challenges that can significantly affect their operations. One of the foremost challenges is security, particularly concerning data breaches and fraud, which not only pose risks of financial loss but also threaten the integrity of a company’s reputation. Companies are also compelled to adhere to various regulations and standards, such as the General Data Protection Regulation (GDPR) and the Payment Card Industry Data Security Standard (PCI DSS). Proper compliance is essential to avoid potential penalties and to maintain customer trust in their services.

Another challenge lies in the rapid evolution of technology. To remain competitive, businesses must continually invest in updates and innovations that meet the ever-changing expectations of their customers. Integration of new payment solutions with existing systems poses additional hurdles, necessitating a focus on ensuring a seamless user experience across various devices. As such, effectively addressing these multifaceted challenges is pivotal for businesses striving for success in the dynamic and fiercely competitive arena of the ePayment system market.

EPayment System Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- Cybersource

- LVX System

- Ingenico ePayments

- Nakagawa Labs

- Geobridge Corporation

- VLNComm

- Philips

- Braintree

- LightPointe Communications

- Bluefin Payment Systems

- Elavon

- General Electric

- Shift4 Corporation

- Intelligent Payments

- TNS Tokenex pureLiFi

- Sisa Information Security Signifyd

- Oledcomm

- Velmenni

- Wipro

ePayment System Market Company News 2024 and 2025

Cybersource (A Visa company)

Multiple security and compliance updates in 2024, including mandates for 8-digit BINs, enhanced p12 key security, and new Visa Secure requirements (effective August 2024) to enhance data quality and fraud dispute rights. Published a “2025 Global eCommerce Payments & Fraud Report.”

Ingenico ePayments (Part of Worldline)

Launched a new all-in-one integrated POS, the AXIUM CX9000, in March 2025. Began the global rollout of its next-generation device management solution, Ingenico Manage 360, in September 2025, which aims to reduce service costs and streamline device management.

Elavon (A subsidiary of U.S. Bank)

Expanded partnerships in 2024 and 2025, including: an expanded payments partnership with WooCommerce to North America (July 2025), a collaboration with Wyndham Hotels & Resorts for its Cloud Payments Interface (June 2025), and a partnership with Liberis to launch a small business funding solution, Quick Capital (August 2025). Also won new business like providing ‘Tap to Pay on iPhone’ for Delta Air Lines (July 2024).

Wipro

Announced several major partnerships and business wins in 2025, focusing heavily on AI and digital transformation, including partnerships with CrowdStrike for AI-powered unified security services and Google Cloud for Agentic AI solutions. While Wipro is a large technology consulting firm, these moves reinforce their ability to deliver advanced, secure digital solutions which directly support their ePayment and Fintech clients.

Segmented View of the Industry:

The ePayment System Market Is Mapped Through A Multidimensional Lens-Tracking Shifts Across Product Type, Applications, And Geographic Regions. This Segmented Approach Enables Businesses to Localize Their Growth Plans And Align Offerings With The Most Profitable Demand Centres.

Segmentation By Component/Solution

- Payment Gateway Solutions

- Payment Processing Solutions

- Payment Wallet/Mobile Wallet Solutions

- Point of Sale (POS) Solutions

- Payment Security & Fraud Management

Segmentation ByPayment Mode

- Credit Cards

- Debit & Other Cards

- E-Wallet/Digital Wallet

- Bank Transfer (ACH, Wire)

- Cash on Delivery (COD)

Segmentation ByEnd-Use Industry

- Retail & E-commerce

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Healthcare

- Transportation & Logistics

- Media & Entertainment

Segmentation ByDeployment Mode

- On-premise

- Cloud-based

Segmentation by Transaction Type

- Domestic

- Cross-border

Segmentation by Enterprise Size

- Large Enterprises

- Small and Medium Enterprises (SMEs)

Global Geographic Coverage:

The Report Provides In-Depth Qualitative And Quantitative Data On The ePayment System Market For All Of The Regions And Countries Listed Below:

North America

In North America, the ePayment System market is expected to grow significantly, fueled by a robust GDP growth rate of 4.5% and a low inflation rate of 2.1%. A major factor driving this growth is the increasing consumer preference for contactless payment methods, reflecting a cultural shift towards convenience and efficiency. Online platforms dominate the ePayment landscape, while mobile payment applications are emerging as the fastest-growing channel, attributed to their user-friendly nature.

Consumers in this market are increasingly focused on sustainability and ethical sourcing in their purchasing decisions, making these factors essential for companies aiming to succeed in the region. In contrast, emerging markets within North America reveal a preference for price and status over ethical considerations, prompting ePayment providers to develop competitive pricing strategies and offer unique benefits to effectively attract and retain customers. As these market dynamics unfold, businesses will need to adapt to the varying consumer preferences across different segments to establish a robust foothold in the North American ePayment landscape.

Europe

The ePayment System Market in Europe is on a path of steady growth, reflected in a projected GDP growth rate of 2.5% and an inflation rate of 1.8%. Within Spain, a significant local factor driving the ePayment system market is the government’s increasing push for a cashless society, which is encouraging both businesses and consumers to shift towards electronic payment methods. Mobile banking applications are currently the dominant channel for ePayment systems in Spain, whereas contactless payments via wearable devices are identified as the fastest-growing channel. Additionally, Spanish consumers are placing a high value on sustainability and ethical sourcing when selecting ePayment solutions, indicating that these aspects are becoming essential features. In contrast, in emerging markets such as Poland and Hungary, where consumer preferences are influenced heavily by price and status, the key determinants for the adoption of ePayment systems are affordability and perceived value.

Asia Pacific

In the Asia Pacific ePayment System Market, significant trends and drivers influence the landscape, particularly in India. The region anticipates a GDP growth of 5% paired with an inflation rate of 2%, indicating a stable economic environment conducive to digital payment innovations. A crucial factor in India’s ePayment dynamics is the government’s Digital India initiative, which has spurred a notable increase in the adoption of ePayment methods among both consumers and businesses. Within this framework, mobile wallets stand out as the predominant channel, while the Unified Payments Interface (UPI) emerges as the fastest-growing option, highlighting a shift towards more integrated digital solutions.

Moreover, consumer preferences in India indicate a strong inclination towards localism and ethical sourcing, asserting that sustainability has become an essential criterion for ePayment providers looking to capture market share. This trend reflects a broader consumer consciousness that prioritizes ethical practices alongside technological advancement. In contrast, emerging markets such as Bangladesh and Indonesia present different motivators for ePayment system adoption. In these regions, considerations of affordability and convenience prevail, driven by a consumer base that weighs price and social status more heavily. Consequently, ePayment providers in these markets must tailor their offerings to meet the unique demands of these differing consumer landscapes, focusing on competitive pricing and accessible services to enhance adoption rates.

Middle East and Africa

The ePayment System Market in the Middle East and Africa is poised for substantial growth, fueled by increasing GDP and low inflation rates in the region. In the Middle East, government initiatives aimed at fostering digitalization are pivotal, with subsidies for ePayment transactions playing a crucial role in promoting adoption. Conversely, in Africa, a cultural festival that highlights the digital economy serves as a significant catalyst for the embrace of ePayment systems. Mobile payment platforms dominate the ePayment landscape and are identified as the fastest-growing channel, largely due to the widespread adoption of smartphones among consumers. Notably, in many emerging markets, the factors that consumers prioritize in ePayment solutions include affordability and convenience, often overshadowing concerns over sustainability, ethical sourcing, or localism. Nevertheless, an emerging trend towards sustainable and ethical ePayment options is observable in certain urban areas, indicating a potential shift in consumer preferences in the future.

Reasons To Buy:

- The Research Would Help Top Administration/Policymakers/Professionals/Product Advancements/Sales Managers And Stakeholders In This Market In The Following Ways.

- The Report Provides EPayment System Market Revenues At The Worldwide, Regional, And Country Levels With A Complete Analysis To 2034 Permitting Companies To Analyze Their Market Share And Analyze Projections, And Find New Markets To Aim For.

- To Understand The Most Affecting Driving And Restraining Forces In The Market And Their Impact On The Global Market.

- Major Changes And Assessment In Market Dynamics And Developments.

- The Objective Of The EPayment System Market Report Is To Identify New Business Opportunities Using Quantitative Market Forecasts.

- Formulate Sales And Marketing Strategies By Gaining An Understanding Of Competitors, Their Positioning, And Strengths & Weaknesses.

Faq – What Global Leaders Are Asking

What Is The Growth Prospect For The ePayment System Market By 2034?

EPayment System Market Is Expected To Achieve A Stable Growth Rate With A Compound Annual Growth Rate (CAGR) Of About 21.74% From 2025 Through 2034.

What Is Driving The Growth Of The ePayment System Market?

The growth of the ePayment system market is primarily driven by the accelerating global shift from cash to digital transactions fueled by booming e-commerce, high smartphone penetration, demand for real-time payments, and continuous innovation in security (AI/ML) and convenience (contactless/biometrics).

Who Are The Key Players In The ePayment System Market, And What Are Their Market Shares?

The EPayment System Market Includes Major Companies Cybersource, LVX System, Ingenico ePayments, Nakagawa Labs, Geobridge Corporation, VLNComm, Philips, Braintree, LightPointe Communications, Bluefin Payment Systems, Elavon, General Electric, Shift4 Corporation, Intelligent Payments, TNS Tokenex pureLiFi, Sisa Information Security Signifyd, Oledcomm, Velmenni, Wipro, Others.

Specific Market Share Data Is Not Publicly Available And Is Typically Provided In Detailed, Proprietary Market Research Reports.

Which Regions Are Leading The ePayment System Market Growth?

The Asia-Pacific region, particularly China and India, is the fastest-growing market, while North America remains the largest by revenue share.

Customized Report as per your Business Needs

- Our analysts will work directly with you and understand your needs

- Get data on specified regions or segments, competitor and Vendors

- Data will be formatted and presented as per your requirements

Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us/

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/