Automotive Sensors Market Size, Trends Analysis Research Report by Sensor Type (Pressure Sensors, Temperature Sensors, Speed Sensors, Position Sensors, Electro-Optical Sensors (including LiDAR, RADAR, and Cameras), Gas Sensors, Motion Sensors), by Vehicle Type (Passenger Cars, Commercial Vehicles), by Application, by Sales Channel, and by Region Global Market Analysis and Forecast, 2025-2034

Sep-2025 Formats | PDF | Category: Automotive | Delivery: 24 to 72 Hours

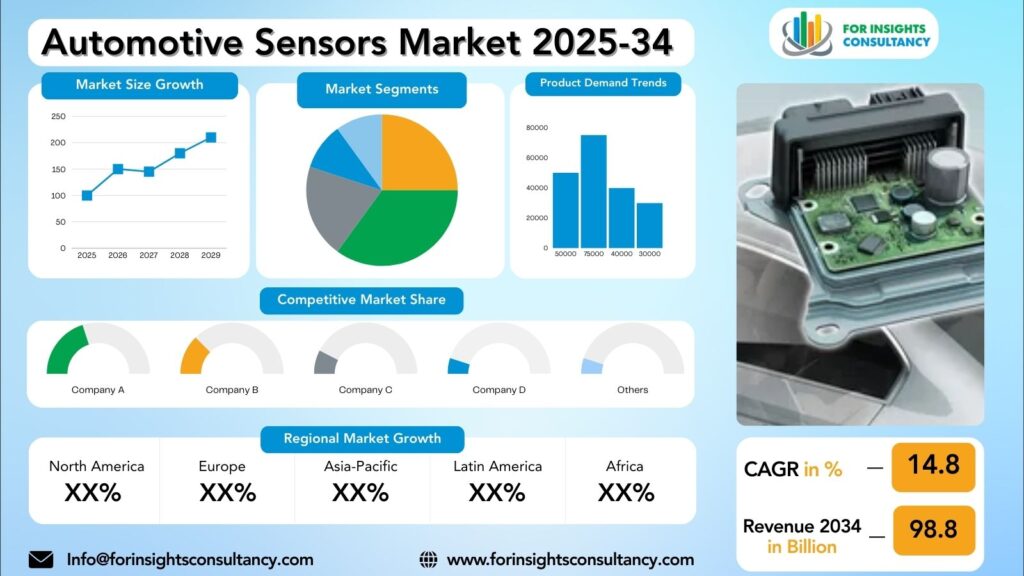

Automotive Sensors Market is forecast to increase from USD 42.9 Billion in 2025 to USD 98.8 Billion by 2034, at a CAGR of 14.8%.

Automotive Sensors Market: A Comprehensive Overview and Future Developments

Automotive sensors are crucial devices that detect environmental changes and convert them into signals for the vehicle’s electronic control unit (ECU). They monitor parameters like temperature, pressure, speed, and proximity to ensure optimal performance and safety. The Automotive Sensors Market is undergoing several trends, including the integration of artificial intelligence and machine learning technologies, which enable real-time data analysis and predictive maintenance, improving vehicle performance and reliability. The emergence of LiDAR sensors for autonomous driving applications is revolutionizing the industry by creating high-resolution 3D maps of the vehicle’s surroundings.

The demand for sensors that monitor battery performance and optimize charging processes is also increasing with the advent of electric vehicles. The Automotive Sensors Market is poised for continued growth and innovation, with advanced sensor technologies like solid-state LiDAR and in-cabin monitoring systems enhancing safety, efficiency, and sustainability. As the automotive industry transitions towards electric and autonomous vehicles, the role of sensors will become even more critical, driving the evolution of vehicle technology and shaping the future of mobility.

Automotive Sensors Market Dynamics

Growth Drivers

The automotive sensors market is experiencing growth due to technological advancements, increasing focus on vehicle safety, and the shift towards electric vehicles. Automotive manufacturers are investing in advanced sensor technologies to improve driver assistance systems, enhance vehicle-to-vehicle communication, and enable self-driving capabilities. Safety features like automatic emergency braking, lane departure warning, and adaptive cruise control are essential, and governments worldwide are implementing strict safety regulations.

The shift towards electric vehicles requires sensors to monitor battery performance, motor efficiency, and charging systems. As consumers adopt environmentally-friendly transportation options, the demand for sensors that optimize electric vehicle performance is expected to rise. The automotive industry is also embracing Industry 4.0 principles, which focus on automation, data exchange, and smart technologies. As automotive manufacturers adopt these principles, the demand for advanced sensors will continue to grow.

Restraints

The automotive sensors market faces several challenges, including cost constraints, technological complexity, regulatory compliance, and data security concerns. The cost of sensor technology can significantly impact vehicle costs, making mass-market adoption challenging, particularly in price-sensitive segments. The rapid advancement of sensor technology has led to increasingly complex sensors with enhanced capabilities, but also presents challenges in integration, calibration, and maintenance.

Manufacturers must balance technological sophistication with practical usability. Regulatory compliance is crucial for vehicle safety and reliability, often requiring specific sensors for functions like emissions control, collision detection, and driver assistance systems. Navigating the regulatory landscape and ensuring compliance can be a significant challenge for manufacturers. Data security is also a critical concern, as sensors collecting and transmitting sensitive data are vulnerable to cyber threats and hacking attempts. Ensuring robust cybersecurity measures to protect this data presents a significant challenge for the automotive sensors market.

Opportunities

The automotive sensors market is experiencing rapid growth due to technological advancements and the growing demand for smart and connected vehicles. Key opportunities for growth include increasing focus on safety, which is a top priority for consumers and regulators. Automotive sensors play a crucial role in enhancing vehicle safety through features like automatic emergency braking, lane departure warning, and adaptive cruise control. The shift towards electric vehicles is creating new opportunities for sensor manufacturers, as they require specialized sensors for battery management and electric motor control.

Automotive sensors are increasingly integrated with advanced technologies like artificial intelligence, machine learning, and connectivity, enhancing vehicle safety, convenience, and efficiency. Manufacturers that successfully integrate these technologies into their sensor offerings will have a competitive edge in the market.

Lastly, the growing focus on environmental sustainability is another key factor in the automotive sensors market. By optimizing fuel efficiency, reducing emissions, and supporting alternative fuel technologies, sensor manufacturers can capitalize on this trend and gain a competitive edge in the market.

Challenges

The automotive sensors market faces several challenges, including rapid technological advancements, cost pressures, increasing demand for autonomous vehicles, and cybersecurity concerns. Technological advancements necessitate constant innovation and adaptation, requiring significant investment in research and development. Cost pressures arise from consumers’ demand for high-quality sensors at affordable prices, which can be challenging to balance with maintaining product quality.

The rise of autonomous vehicles presents both opportunities and challenges, as they require a wide range of sensors to navigate and interact with their environment. However, the complexity and volume of sensors can strain supply chains and production processes. Cybersecurity concerns are also a major concern, as hackers can potentially access and manipulate sensors, compromising vehicle safety and performance. To protect their products and maintain consumer trust, companies in the automotive sensor market must invest in robust cybersecurity measures.

Automotive Sensors Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- Robert Bosch GmbH (Germany)

- ON Semiconductor (US)

- OMNIVISION (US)

- TE Connectivity (Germany)

- Continental AG (Germany)

- Infineon Technologies AG (Germany)

- NXP Semiconductors (Netherlands)

- Denso Corporation (Japan)

- Panasonic (Japan)

- Allegro MicroSystems, Inc. (US)

- Sensata Technologies,Inc (US)

- BorgWarner, Inc. (US)

- Analog Devices, Inc. (US)

- ELMOS Semiconductor SE (Germany)

- (Ireland)

- CTS Corporation (US)

- Autoliv, Inc. (Sweden)

- STMicroelectronics (Switzerland)

- ZF Friedrichshafen AG (Germany)

- Quanergy Solutions, Inc. (US)

- Innoviz Technologies Ltd (Israel)

- Valeo S.A. (France)

- Magna International Inc. (Canada)

- Melexis (Belgium)

- Amphenol Advanced Sensors (US)

Automotive Sensors Market News

Continental

In August 2025, Continental announced it had produced its 200 millionth automotive RADAR sensor, highlighting its leading position with over 20% market share. This was supported by major new orders worth around EUR 1.5 billion, with production scheduled for 2026 and 2027.

Bosch

In July 2025, Bosch unveiled its new SX600 and SX601 system-on-chips (SoCs), which are specifically designed for advanced ADAS applications up to SAE Level 2+. These new chips operate in the 77 GHz frequency band and use AI for improved perception, with the ability to detect small and distant objects with high accuracy.

Mobileye

In May 2025, Mobileye announced that a leading global automaker selected its Mobileye Imaging Radar™ as a key component for its upcoming Level 3 automated driving system, scheduled for production in 2028. This represents a significant validation of Mobileye’s “vision-first” approach complemented by a high-definition radar.

Infineon Technologies

At CES 2025, Infineon showcased its latest solutions for 77/79 GHz radar chips, which enable higher resolution and more precise object detection for applications such as corner radar and in-cabin sensing.

Segmented View of the Industry: ADAS and Safety Systems segment is the largest

The Automotive Sensors Market Is Mapped Through A Multidimensional Lens-Tracking Shifts Across Product Type, Applications, And Geographic Regions. This Segmented Approach Enables Businesses To Localize Their Growth Plans And Align Offerings With The Most Profitable Demand Centers.

Segmentation by Sensor Type

- Pressure Sensors

- Temperature Sensors

- Speed Sensors

- Position Sensors

- Electro-Optical Sensors (including LiDAR, RADAR, and Cameras)

- Gas Sensors

- Motion Sensors

Segmentation by Application

- Powertrain

- ADAS and Safety Systems

- Chassis

- Vehicle Body Electronics

- Telematics

Segmentation by Vehicle Type

- Passenger Cars

- Commercial Vehicles

Segmentation by Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Global Geographic Coverage: Asia-Pacific region is the largest and fastest-growing market for automotive sensors.

The Report Provides In-Depth Qualitative and Quantitative Data On the Automotive Sensors Market For All Of The Regions And Countries Listed Below:

North America

The United States is a major market for automotive sensors in North America, driven by a strong automotive industry and a high demand for advanced technologies. Key players in the market include Bosch, Continental AG, and Denso Corporation. The growing focus on vehicle safety, emission regulations, and electric and autonomous vehicles has led to a diverse and rapidly evolving market.

Canada, a smaller market, has a significant automotive industry that relies on sensors for various applications. Key players in the Canadian market include Magna International, Delphi Technologies, and TE Connectivity. They are driving innovation in sensor technology and bringing advanced solutions to meet the evolving needs of the Canadian automotive industry.

Mexico, a major hub for automotive production, has a growing market for sensors in vehicles. Major automotive manufacturers like General Motors, Ford, and Volkswagen are driving the demand for sensors. Key players in the Mexican automotive sensors market include Aptiv, NXP Semiconductors, and Robert Bosch, investing in research and development to bring cutting-edge sensor solutions to the Mexican automotive industry.

Europe

Germany, a key player in the European automotive market, is renowned for its strong automotive industry, with leading manufacturers like Volkswagen, BMW, and Mercedes-Benz. The demand for automotive sensors in Germany is driven by its focus on innovation and quality, and is expected to grow significantly in the coming years. France, with companies like Renault and Peugeot dominating the industry, is also driven by its emphasis on sustainability and environmental conservation. As the French government pushes for the adoption of electric vehicles, the need for advanced sensors to support these vehicles is growing rapidly.

Italy, known for its luxury sports cars, also has a thriving automotive industry that relies heavily on sensors, with brands like Ferrari and Lamborghini leading the charge.

The UK, with its long history of automotive manufacturing, is driven by safety and security, with the demand for sensors supporting technologies like Advanced Driver Assistance Systems (ADAS) on the rise. Spain, with companies like SEAT and Renault operating in the country, has a growing demand for automotive sensors, focusing on efficiency and cost-effectiveness.

In conclusion, the automotive sensors market in Europe is diverse and dynamic, with each country offering unique opportunities and challenges. By staying ahead of the curve and investing in cutting-edge sensor technology, companies in Europe can position themselves at the forefront of the automotive industry.

Asia Pacific

China, the world’s largest automotive market, is experiencing a surge in demand for advanced sensors due to its rapid industrialization and urbanization. The government’s push towards electric vehicles and smart transportation systems is expected to increase the demand for sensors like LiDAR, radar, and ultrasonic sensors. This presents a significant opportunity for sensor manufacturers to tap into the Chinese market.

Japan, known for its technological innovations, is a key player in the global automotive sensors market. With companies like Toyota, Honda, and Nissan pushing the boundaries of automotive technology, the demand for sensors in Japan is expected to remain robust. South Korea, known for its expertise in semiconductor manufacturing, is also a key market for automotive sensors. Companies like Hyundai and Kia are focusing on developing autonomous vehicles, enhancing driver safety, and improving vehicle performance.

India, with its rapidly growing economy and burgeoning automotive industry, is a key market for automotive sensors in the Asia Pacific region. The country’s focus on reducing emissions and promoting electric mobility is driving the demand for sensors like oxygen sensors, temperature sensors, and gas sensors. Indian sensor manufacturers are investing in research and development to meet the evolving needs of the automotive market.

Middle East and Africa

Automotive sensors are essential for optimal performance, safety, and efficiency in vehicles. The global automotive sensors market is experiencing rapid growth due to technological advancements, increased demand for connected vehicles, and stringent regulations. The Middle East, particularly Saudi Arabia, UAE, and Qatar, is experiencing significant growth in vehicle sales and production due to the adoption of advanced driver-assistance systems (ADAS) and electric vehicles. Saudi Arabia’s government initiatives promote clean energy and enhance road safety, creating a favorable environment for sensor manufacturers and suppliers.

The UAE is emerging as a hub for automotive innovation, investing in smart transportation solutions and autonomous driving technologies. The demand for sensors in the UAE is expected to grow exponentially in the coming years due to real-time data analytics and predictive maintenance in vehicles. Africa presents unique opportunities and challenges for the automotive sensors market, with countries like South Africa, Nigeria, and Kenya experiencing growing demand for sensors due to the expansion of automotive manufacturing facilities and the adoption of IoT technologies. South Africa’s automotive industry is a key contributor to the country’s economy, with major players investing in research and development to enhance vehicle performance and safety.

Reasons to Buy:

- The Research Would Help Top Administration/Policymakers/Professionals/Product Advancements/Sales Managers And Stakeholders In This Market In The Following Ways.

- The Report Provides Automotive Sensors Market Revenues At The Worldwide, Regional, And Country Levels With A Complete Analysis To 2034 Permitting Companies To Analyze Their Market Share And Analyze Projections, And Find New Markets To Aim For.

- To Understand The Most Affecting Driving And Restraining Forces In The Market And Their Impact On The Global Market.

- Major Changes And Assessment In Market Dynamics And Developments.

- The Objective Of The Automotive Sensors Market Report Is To Identify New Business Opportunities Using Quantitative Market Forecasts.

- Formulate Sales And Marketing Strategies By Gaining An Understanding Of Competitors, Their Positioning, And Strengths & Weaknesses.

Faq – What Global Leaders Are Asking

What Is The Growth Prospect For The Automotive Sensors Market By 2034?

Automotive Sensors Market Is Expected To Achieve A Stable Growth Rate With A Compound Annual Growth Rate (Cagr) Of About 14.8% From 2025 Through 2034.

What Is Driving The Growth Of The Automotive Sensors Market?

The growth of the automotive sensors market is driven by the increasing integration of Advanced Driver-Assistance Systems (ADAS) and the development of autonomous vehicles. This is further fueled by stricter government safety regulations and the widespread adoption of electric vehicles, which require a high density of sensors for safety, battery management, and performance.

Who Are The Key Players In The Automotive Sensors Market, And What Are Their Market Shares?

The Automotive Sensors Market Includes Major Companies Like Robert Bosch GmbH (Germany), ON Semiconductor (US), OMNIVISION (US), TE Connectivity (Germany), Continental AG (Germany), Infineon Technologies AG (Germany), NXP Semiconductors (Netherlands), Others.

Specific Market Share Data Is Not Publicly Available and Is Typically Provided In Detailed, Proprietary Market Research Reports.

Which Regions Are Leading the Automotive Sensors Market Growth?

The Asia-Pacific region is the clear leader in the automotive sensors market, driven by its high volume of vehicle production and the rapid adoption of advanced safety and infotainment features. North America and Europe also hold significant market shares, fueled by strict safety regulations and strong consumer demand for autonomous and connected vehicle technologies.

Customization: We Can Provide Following Things

1) On Market More Company Profiles (Competitors)

2) Data About Particular Country Or Region

3) We Will Incorporate The Same With No Additional Cost (Post Conducting Feasibility).

Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us/

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/