Laser Marking Market Research Report Data by Type (Fiber Laser, Diode Laser, Solid State Laser, CO2 Laser) End-Use (Machine Tools, Semiconductor & Electronics, Automotive, Medical & Healthcare, Aerospace & Defense, Packaging) Offering (Hardware, Software, Services) Region (North America, Asia Pacific, Europe, South America, Middle East & Africa), Global Trends and Forecast from 2024 to 2030

Pages: 123 | Dec-2023 Formats | PDF | Category: Information and Technology | Delivery: 24 to 72 Hour

Laser Marking Market Outlook (2024 to 2030)

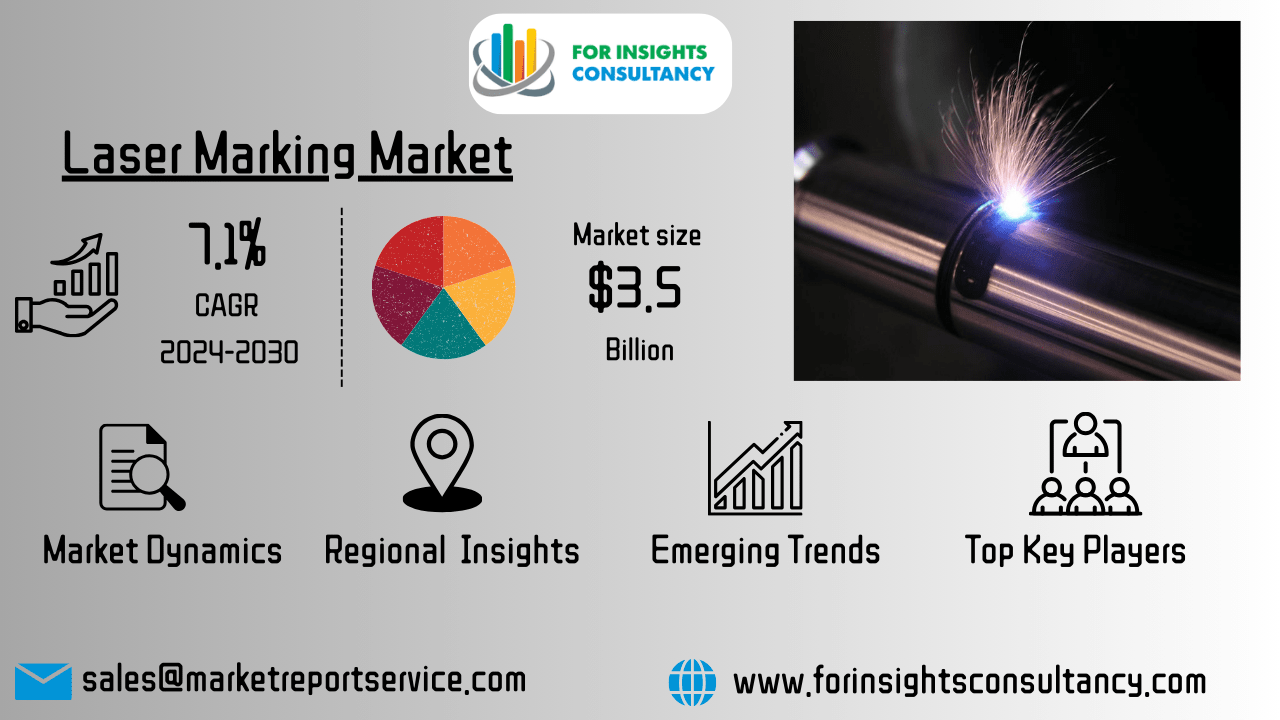

From 2024 to 2030, the global laser marking market is projected to expand at a compound annual growth rate of 7.1%. It is anticipated to increase from USD 2.17 billion in 2023 to over USD 3.5 billion by 2030.

In its most basic form, laser marking is a permanent process that uses a focussed light beam to generate a permanent mark on a surface. Laser marking has several applications and is commonly done with fiber, pulsed, continuous wave, green, or UV laser equipment.

Laser marking on steel, titanium, aluminum, copper, ceramic, plastic, glass, wood, paper, and cardboard can be automated and done fast, leaving permanent traceable markings. Text (including serial numbers and component numbers); machine-readable data (such as barcodes, Unique ID codes, and 2D Data Matrix codes); or graphics can be used to identify components and products.

Laser marking is expected to grow over the forecast period, due to the increasing applicability of the technology in all major end-use industries. The laser marking market is also expected to grow due to its superior performance to traditional engraving and marking techniques. High implementation costs could limit market growth. The laser marking market is expected to benefit from the increasing trend of automation within manufacturing industries during the forecast period.

Growth Drivers

The growing industrialization has increased the demand for laser technology. This is used to code and mark logos, barcodes and QR codes. The laser marking market is expected to benefit from this functionality. Laser marking has a large market due to the growing automotive, aerospace, electronic, pharmaceutical, medical, cosmetic, and pharmaceutical industries.

These industries also require laser marking machines for marking on leather, glass bottles and metals as well as plastics, labels and PP for brand protection and traceability. Laser branding can reduce fatigue life, and cause fatigue cracks. Laser marking is also critical. Selecting the wrong spot can lead to early failure and act as a limitation.

Product developers, however, are focusing on the design and manufacturing of their products, which will drive the market’s growth.

Restraining Factors

The lasers needed for systems, processes, and applications range from a few hundred watts to thousands. High-power lasers can be used for large-scale laser display, medical, military research, laser-induced nucleofusion, material processing, (welding and cutting, drilling and soldering), surface modification, marking and surface modification. Laser marking is a cost-effective way to reduce the workforce in automotive and manufacturing. However, it requires a significant investment.

Covid-19 Impact

In 2022, many countries faced strict lockdowns due to the covid-19 pandemic. These lockdowns have resulted in the partial or complete shutdown of manufacturing facilities. The shutdown of manufacturing facilities had a major impact on the consumption of materials.

This led to reduced transportation resulting in a slowing down of updating the railway system. However, with the ease of lockdown manufacturing sector is expected to return to its normal growth. The global laser marking market is crowded with established players.

These players have a commanding say in the market. The technology used in the laser marking market is proprietary and needs long-term research and development planning implemented efficiently.

Laser Marking Market Segment Analysis

The laser marking market can be divided by type into diode, fiber, solid-state, and CO2 lasers. In 2022, fiber lasers will dominate the laser marking market. In 2022, fiber lasers held the largest share of the market for laser marking.

Fiber lasers are gaining popularity due to their high output power and flexible fiber light. They also have a compact size and excellent optical quality. A fiber laser uses an optical fiber that is doped to act as a gain medium. Fiber lasers can be used for laser engraving and marking applications in the semiconductor, electronics, medical, and military industries.

They are available in different power modes, including continuous wave and modulated.

The laser marking market can be segmented by end-use into machine tools (including semiconductors & electronics), automotive, medical & health care, aerospace & defence, and packaging. Machine tools will continue to lead the laser-marking market for the entire projected period. The machine tools vertical will have the highest share of the laser-marking market during the forecast period. The ability of laser markers to permanently mark alphanumeric information on objects, such as logos, designs and manufacturer codes has helped propel this vertical to market leadership.

The laser marking market can be divided into three categories: hardware, software and services. In 2022, the hardware market will have the largest share in the laser marking industry. In 2022, the market for laser marking was dominated by hardware offerings. This high market share can be attributed in part to the hardware requirements for different types of laser marking equipment. Laser marking and engraving machines require a number of components to function properly. These include the laser, the controller, the filter, rotary device, galvanometer and power supply.

Top Key Players Profiled in the Laser Marking Market

From large companies to small ones, many companies are actively working in the laser marking market. These key players include Coherent, Han’s Laser, Trumpf, Gravotech, Jenoptik, Epilog Laser,600 Group, Mecco, Laserstar, Novanta, and others.

New Developments

- 13 Apr 2023, Gravotech presents the Mini-inline, its new concept for a secure laser marking, designed for industrial companies and integrators wishing to free themselves from the complexity and cost of a class 1 laser enclosure.

- In May 2018, Trumpf (Germany) invested USD 27.0 million in its Chinese subsidiary, JFY, and TRUMPF China to improve its production capacity and capabilities.

- In January 2018, Jenoptik (Germany) established an application centre in Silicon Valley, California, to capitalise on business expansion in the United States.

- In April 2016, Gravotech (France) has released an improved version of their engraving software, Gravostyle, which is a management tool for laser and mechanical engraving equipment. The Laserstyle interface supports this programme, which may be used for 3D engraving.

Laser Marking Market Country-wise Insights

Asia Pacific, North America (NA), Middle East and Africa, and Europe are the major players in this market. Asia Pacific accounts for 38% of total market. A growing number of laser-marking production plants, as well as the rapid use of laser-marking are factors that contribute to the market growth in the region. Due to the low cost of labor and availability of raw materials, the market is growing in the region.

Han’s Laser Technology Industry Group is one of the most active players on the market in Asia-Pacific. The Asia-Pacific market has seen a notable growth due to the investments made by various players in their growth and development through partnerships and expansion strategies.

The market has seen a variety of research and development to produce stable and high-quality outcomes. FarsoonTechnologies is a Chinese manufacturer who produces industrial-grade metal and plastic laser melting systems. They developed an additive manufacturing method that allows them to print structures entirely made of copper with standard fiber lasers. The company has also shown a part created with this process at TCT Asia – one of Asia-Pacific’s largest industrial additive manufacturing exhibitions.

Segments Covered in the Laser Marking Market

Laser Marking Market by Type

- Fiber Laser

- Diode Laser

- Solid State Laser

- Co2 Laser

Laser Marking Market by End-Use

- Machine Tools

- Semiconductor & Electronics

- Automotive

- Medical & Healthcare

- Aerospace & Defense

- Packaging

Laser Marking Market by Offering

- Hardware

- Software

- Services

Frequently asked questions

What are the growth opportunities in laser marking market, globally?

Market growth will be driven by the increasing use of laser marking in a wide range of end-use industries.

What is the CAGR of laser marking market?

The global laser marking market registered a CAGR of 7.1% from 2024 to 2030.

Which are the top companies to hold the market share in the Laser Marking market?

The report profiles Coherent as well as Han’s Lasers, Gravotechs, Jenoptiks, Epilog Lasers, 600 Group, Meccos, Laserstars, Novanta, and others.

Which is the largest regional market for laser marking market?

Asia Pacific holds the largest regional market for the laser marking market.

Table of Content

- Introduction

1.1. Laser Marking Market Definition

1.2. Market Segmentation

1.3. Research Timelines

1.4. Assumptions and Limitations

- Research Methodology

2.1. Data Mining

2.1.1.Secondary Research

2.1.2.Primary Research

2.1.3.Subject-Matter Experts’ Advice

2.2. Quality Checks

2.2.1.Final Review

2.3. Data Triangulation

2.3.1.Bottom-Up Approach

2.3.2.Top-Down Approach

2.3.3.Research Flow

2.4. Data Types

- Executive Summary

- Laser Marking Market Overview

4.1. Global Market Outlook

4.1.1. Market Drivers

4.1.2. Market Restraints

4.1.3. Market Opportunities

4.2. Impact of Covid-19 On Global Market

- Global Laser Marking Market by Type, (USD Million)

5.1. Fiber Laser

5.2. Diode Laser

5.3. Solid State Laser

5.4. CO2 Laser

- Global Laser Marking Market by End-Use, (USD Million)

6.1. Machine Tools

6.2. Semiconductor & Electronics

6.3. Automotive

6.4. Medical & Healthcare

6.5. Aerospace & Defense

6.6. Packaging

- Global Laser Marking Market by Offering, (USD Million)

7.1. Hardware

7.2. Software

7.3. Services

- Global Laser Marking Market by Region, (USD Million)

8.1. Introduction

8.2. Asia-Pacific

8.2.1.China

8.2.2.India

8.2.3.Japan

8.2.4.South Korea

8.2.5.Australia

8.2.6.South-East Asia

8.2.7.Rest of Asia-Pacific

8.3. North America

8.3.1.United States

8.3.2.Canada

8.3.3.Mexico

8.4. Europe

8.4.1.Germany

8.4.2.United Kingdom

8.4.3.France

8.4.4.Italy

8.4.5.Spain

8.4.6.Russia

8.4.7.Rest of Europe

8.5. South America

8.5.1.Brazil

8.5.2.Argentina

8.5.3.Colombia

8.5.4.Rest of South America

8.6. Middle East and Africa

8.6.1.UAE

8.6.2.Saudi Arabia

8.6.3.South Africa

8.6.4.Rest of Middle East and Africa

- Company Profiles*

9.1. Coherent

9.2. Han’s Laser

9.3. Trumpf

9.4. Gravotech

9.5. Jenoptik

9.6. Epilog Laser

9.7. 600 Group

9.8. Mecco

9.9. Laserstar

9.10. Novanta

List of Tables

Table 1 Global Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 2 Global Laser Marking Market By Filter Media (USD Millions) 2023-2030

Table 3 Global Laser Marking Market By End User (USD Millions) 2023-2030

Table 4 Global Laser Marking Market By Region (USD Millions) 2023-2030

Table 5 Us Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 6 Us Market By Filter Media (USD Millions) 2023-2030

Table 7 Us Market By End User (USD Millions) 2023-2030

Table 8 Canada Market By Fabric Material (USD Millions) 2023-2030

Table 9 Canada Market By Filter Media (USD Millions) 2023-2030

Table 10 Canada Market By End User (USD Millions) 2023-2030

Table 11 Mexico Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 12 Mexico Market By Filter Media (USD Millions) 2023-2030

Table 13 Mexico Market By End User (USD Millions) 2023-2030

Table 14 Brazil Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 15 Brazil Market By Filter Media (USD Millions) 2023-2030

Table 16 Brazil Market By End User (USD Millions) 2023-2030

Table 17 Argentina Market By Fabric Material (USD Millions) 2023-2030

Table 18 Argentina Market By Filter Media (USD Millions) 2023-2030

Table 19 Argentina Market By End User (USD Millions) 2023-2030

Table 20 Colombia Market By Fabric Material (USD Millions) 2023-2030

Table 21 Colombia Market By Filter Media (USD Millions) 2023-2030

Table 22 Colombia Market By End User (USD Millions) 2023-2030

Table 23 Rest Of South America Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 24 Rest Of South America Market By Filter Media (USD Millions) 2023-2030

Table 25 Rest Of South America Market By End User (USD Millions) 2023-2030

Table 26 India Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 27 India Market By Filter Media (USD Millions) 2023-2030

Table 28 India Market By End User (USD Millions) 2023-2030

Table 29 China Market By Fabric Material (USD Millions) 2023-2030

Table 30 China Market By Filter Media (USD Millions) 2023-2030

Table 31 China Market By End User (USD Millions) 2023-2030

Table 32 Japan Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 33 Japan Market By Filter Media (USD Millions) 2023-2030

Table 34 Japan Market By End User (USD Millions) 2023-2030

Table 35 South Korea Market By Fabric Material (USD Millions) 2023-2030

Table 36 South Korea Market By Filter Media (USD Millions) 2023-2030

Table 37 South Korea Market By End User (USD Millions) 2023-2030

Table 38 Australia Market By Fabric Material (USD Millions) 2023-2030

Table 39 Australia Market By Filter Media (USD Millions) 2023-2030

Table 40 Australia Market By End User (USD Millions) 2023-2030

Table 41 South-East Asia Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 42 South-East Asia Market By Filter Media (USD Millions) 2023-2030

Table 43 South-East Asia Market By End User (USD Millions) 2023-2030

Table 44 Rest Of Asia Pacific Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 45 Rest Of Asia Pacific Market By Filter Media (USD Millions) 2023-2030

Table 46 Rest Of Asia Pacific Market By End User (USD Millions) 2023-2030

Table 47 Germany Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 48 Germany Market By Filter Media (USD Millions) 2023-2030

Table 49 Germany Market By End User (USD Millions) 2023-2030

Table 50 Uk Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 51 Uk Market By Filter Media (USD Millions) 2023-2030

Table 52 Uk Market By End User (USD Millions) 2023-2030

Table 53 France Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 54 France Market By Filter Media (USD Millions) 2023-2030

Table 55 France Market By End User (USD Millions) 2023-2030

Table 56 Italy Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 57 Italy Market By Filter Media (USD Millions) 2023-2030

Table 58 Italy Market By End User (USD Millions) 2023-2030

Table 59 Spain Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 60 Spain Market By Filter Media (USD Millions) 2023-2030

Table 61 Spain Market By End User (USD Millions) 2023-2030

Table 62 Russia Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 63 Russia Market By Filter Media (USD Millions) 2023-2030

Table 64 Russia Market By End User (USD Millions) 2023-2030

Table 65 Rest of Europe Market By Fabric Material (USD Millions) 2023-2030

Table 66 Rest Of Europe Market By Filter Media (USD Millions) 2023-2030

Table 67 Rest Of Europe Market By End User (USD Millions) 2023-2030

Table 68 UAE Market By Fabric Material (USD Millions) 2023-2030

Table 69 Uae Market By Filter Media (USD Millions) 2023-2030

Table 70 Uae Market By End User (USD Millions) 2023-2030

Table 71 Saudi Arabia Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 72 Saudi Arabia Market By Filter Media (USD Millions) 2023-2030

Table 73 Saudi Arabia Market By End User (USD Millions) 2023-2030

Table 74 South Africa Market By Fabric Material (USD Millions) 2023-2030

Table 75 South Africa Market By Filter Media (USD Millions) 2023-2030

Table 76 South Africa Market By End User (USD Millions) 2023-2030

Table 77 Rest Of Middle East And Africa Laser Marking Market By Fabric Material (USD Millions) 2023-2030

Table 78 Rest Of Middle East And Africa Market By Filter Media (USD Millions) 2023-2030

Table 79 Rest Of Middle East And Africa Market By End User (USD Millions) 2023-2030

List of Figures

Figure 1 Market Dynamics

Figure 2 Market Segmentation

Figure 3 Report Timelines: Years Considered

Figure 4 Data Triangulation

Figure 5 Bottom-Up Approach

Figure 6 Top-Down Approach

Figure 7 Research Flow

Figure 8 Global Laser Marking Market By Type, USD Million, 2023-2030

Figure 9 Global Market By End-Use, USD Million, 2023-2030

Figure 10 Global Market By Offering USD Million, 2023-2030

Figure 11 Global Laser Marking Market By Region, USD Million, 2023-2030

Figure 12 Porter’s Five Forces Model

Figure 13 Market By Region 2022

Figure 14 Market Share Analysis

Figure 15 Coherent: Company Snapshot

Figure 16 Han’s Laser: Company Snapshot

Figure 17 Trumpf: Company Snapshot

Figure 18 Gravotech: Company Snapshot

Figure 19 Jenoptik: Company Snapshot

Figure 20 Epilog Laser: Company Snapshot

Figure 21 600 Group: Company Snapshot

Figure 22 Mecco: Company Snapshot

Figure 23 Laserstar: Company Snapshot

Figure 24 Novanta: Company Snapshot

Select PDF License

Single User: $2000

Multiple Users: $3000

Corporate Users: $4000