Financial Cybersecurity Market Size, Trends Analysis Research Report by Component (Solutions, Services), By Deployment Mode (On-Premise, Cloud), and by Organization Size, by Security Type, and by End User, By Region Global Market Analysis And Forecast, 2025-2034

Nov-2025 Formats | PDF | Category: IT | Delivery: 24 to 72 Hours

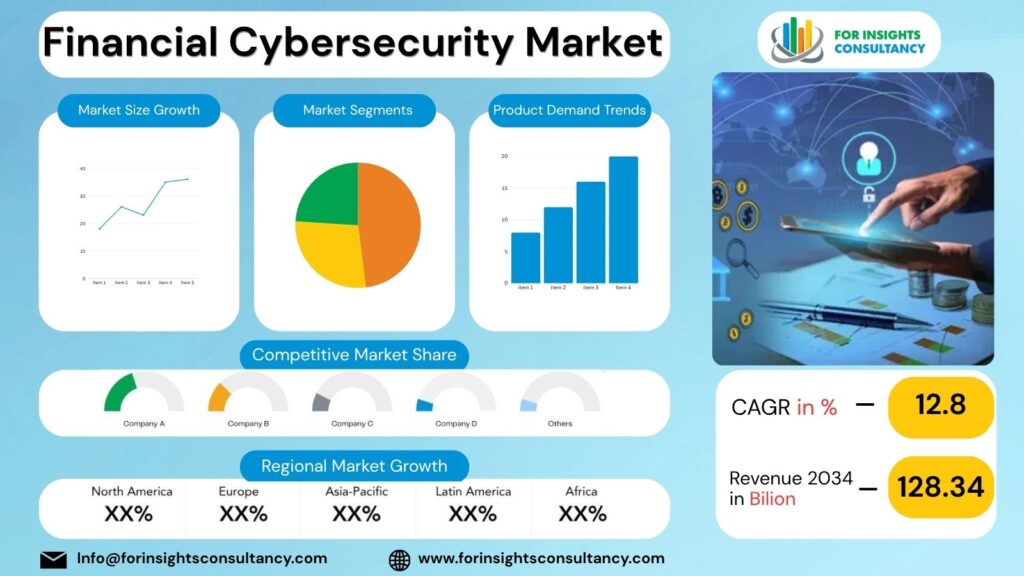

Global Financial Cybersecurity market is expected to reach USD 128.34 Billion by 2034, up from USD 89.32 Billion in 2025. During the forecast period 2025 to 2034, the industry is projected to expand at a CAGR of 12.8%.

Financial Cybersecurity Market Research Summary

The Financial Cybersecurity Market is an ever-changing market that is essential to defray the impact of malicious cyberschemes on financial institutions and customers. The exposition here is an in-depth glance at the present situation as well as the future trends of such a vibrant market.

Unfortunately, the financial sector is also a target for various cybersecurity threats such as ransomware attacks, data breaches, and phishing scams. To this end, institutions are going all out to put in place the most secure cybersecurity measures so as not to give away sensitive data and customer information.

The financial cybersecurity market is undergoing changes that are reflected in its increased reliance on cutting-edge technologies such as AI, machine learning, and blockchain to detect and prevent cyber threats in a proactive manner. Besides, the industry continues to raise the bar for itself in terms of regulatory compliance and risk management.

The financial cybersecurity of tomorrow will depend on the latest breakthroughs in technology, the regulations arising, and the ever more sophisticated cyber threats. The industry players must thus not only anticipate their every move but also keep up with the hackers’ fakery to be one step ahead of them.

The Financial Cybersecurity Market will have no shortage of future opportunities to pool resources with the drive to innovate further and solidify their cybersecurity stance and guard against financial threats that are likely to arise.

Market Insights

- In 2024, the Financial Cybersecurity Market is expected to see significant growth, with the largest revenue share projected to come from the North America region.

- The market analysis forecasts a robust growth rate for this region, driven by the increasing adoption of digital financial services and the rising number of cyber threats.

- The U.S. population in urban areas is expected to contribute to this growth, with an estimated percentage of around 80% living in urban settings by 2024. This urban population is likely to drive the demand for advanced cybersecurity solutions to protect financial data and transactions.

- Within the Financial Cybersecurity Market segments, the largest revenue share is anticipated to come from the financial institutions sector, including banks, insurance companies, and investment firms. These organizations are increasingly investing in cybersecurity measures to safeguard their sensitive financial information and maintain trust with their customers.

Financial Cybersecurity Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- CrowdStrike

- IBM Security

- Palo Alto Networks

- Fortinet, Inc

- Cisco Systems, Inc.

- Symantec Corporation

Financial Cybersecurity Market Company News 2024 and 2025

CrowdStrike Holdings

November 2025: Announced global expansion of their AI/cloud cybersecurity startup accelerator in partnership with Amazon Web Services, Inc. (AWS) and NVIDIA Corporation.

Palo Alto Networks

Jan 28 2025: Announced a joint survey with IBM Corporation showing 75%+ of organisations pursuing “platformisation” of security (integration across hybrid cloud, AI, SOC) – signalling strategic shifts among large buyers in financial/enterprise cybersecurity spend.

Fortinet, Inc

August 6 2025: Q2 2025 results: revenue US $1.63 billion (+14% y/y); billings US $1.78 billion (+15% y/y); Unified SASE ARR +22% y/y; Security Operations ARR +35% y/y.

IBM Corporation

April 16 2025: Published the “IBM X-Force 2025 Threat Intelligence Index” highlighting evolving threat landscape and emphasising cyber resilience.

Market Dynamics

What are the trends of the Financial Cybersecurity market?

The Financial Cybersecurity Market is estimated to experience a substantial growth in 2024 and 2025. The market is expected to grow at a fast pace due to the widespread adoption of digital technologies and online financial services. As the financial institutions and organizations seek to protect their data and systems against cyber-attacks, the need for advanced cybersecurity solutions is getting higher.

The main changes in the Financial Cybersecurity Market in 2024 and 2025 revolve around increased attention to cloud security, the use of AI and machine learning in threat detection and response, the development of quantum-safe cryptography, and the growing adoption of biometric authentication methods. Besides that, compliance with regulations and the need for proactive cybersecurity to fight against complex cyber threats will be the reasons for the financial sector to invest in innovative cybersecurity solutions.

What are the growth drivers of the Financial Cybersecurity market?

The Financial Cybersecurity market is set to expand considerably over the next few years, which is largely attributed to the factors leading this growth. It is estimated that the market will be mainly driven by the escalating number of complex cyberattacks targeting financial institutions in 2024 and 2025. As more customers embrace digital banking and online transactions, cybersecurity providers will benefit from an ever-increasing demand for their solutions among financial institutions. Coerced by regulatory requirements and compliance standards, companies are installing state-of-the-art security systems in their data centers to protect their valuable financial data. Not only that but also, the higher the awareness is of the possible risks related to cyber threats, the more financial institutions are willing to commit to the cybersecurity budgets that will, in turn, accelerate the market penetration.

What are the challenges and restraining factors of the Financial Cybersecurity market?

The Financial Cybersecurity market will have to overcome various challenges as well as restraining factors in the years 2024 and 2025. Some of the foremost challenges heralded include the increasing complicity of cyber threats, for instance, ransomware attacks and data breaches, thereby necessitating the continuous innovative development of cybersecurity solutions for staying ahead of threats. Furthermore, the requirements for regulatory compliance are becoming more rigorous, thus financial institutions bear the burden of investing in strong cybersecurity measures to avoid the risk of penalties and loss of reputation.

Budget restrictions are a few of the other limiting factors for the Financial Cybersecurity market that countless organizations, particularly smaller financial institutions, have, thus their ability to invest in state-of-the-art cybersecurity solutions is hampered. Additionally, the shortage of cybersecurity professionals is a major hurdle as the demand for experts in this area is far more than the supply. To sum up, the Financial Cybersecurity market’s ability to confront these challenges and deal with the restraining factors will determine its level of staying power and flexibility in the rapidly changing cybersecurity environment.

Key Segments

Segmentation By Component

- Solutions

- Services

Segmentation By Deployment Mode

- On-Premise

- Cloud

Segmentation By Organization Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

Segmentation by Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Others

Global Geographic Coverage:

The Report Provides In-Depth Qualitative And Quantitative Data On The Financial Cybersecurity Market For All Of The Regions And Countries Listed Below:

North America

Financial Cybersecurity Market in North America is influenced by the projected GDP Growth of 2.5% and the Inflation Rate of 1.8%. The US market for cybersecurity technologies is reportedly boosted by a particular government subsidy. Online platforms are the major channel for the distribution of financial cybersecurity products in North America as they provide convenience and accessibility to users. The most rapidly expanding channel, however, is the establishment of partnerships with financial institutions to facilitate the integration of cybersecurity solutions into their services. Buyers in this market are highly concerned about the environment and the ethical aspects of the products, thus, these have become indispensable features of financial cybersecurity products. In many emerging markets where price/status is the main factor, offering attractive prices while still maintaining good quality and ethical standards will be the way to success.

Europe

The Financial Cybersecurity Market in Europe and its Sub-Regions offers a bright future to the investors. The area is attractive because of the combination of factors such as a 3% GDP growth rate and an inflation rate of 1.5%. A government grant for companies that invest in cybersecurity technology is a local factor that energizes the market in Spain. The main channel through which financial cybersecurity products get to the end-users in Germany is via already established financial institutions, whereas the quickest developing channel in the UK is by online platforms.

Customers in Scandinavia put sustainability and ethical sourcing as two of the most important attributes of cybersecurity products, thus, they become must-have features. Meanwhile, in a number of emerging markets, e.g., Eastern Europe, the price and the status are still the most significant factors that determine consumer behavior. Businesses that recognize these differences in the European market will be able to successfully adjust their strategies.

Asia Pacific

Projected GDP Growth: The Asia Pacific region is expected to expand its economy by 6.3% according to the GDP growth rate forecast, which shows a vibrant economic environment. Inflation Rate is anticipated to be close to 2.8%.

Local Non-Replicable Driver: In South Korea, the government subsidy for businesses that integrate cybersecurity technologies is the main factor that drives the market. This grant facilitates enterprises to improve their cybersecurity strategies, resulting in increased demand for financial cybersecurity solutions.

Dominant Channel: The main channel through which financial cybersecurity products are marketed in Japan is by the creation of partnerships with the already existing financial institutions. On the contrary, the direct-to-consumer online platform is the fastest-growing channel, which is indicative of the upsurge in demand for personalized cybersecurity solutions.

Consumer Trends: Consumers in emerging markets like Indonesia and India give more importance to price and status than to sustainability, ethical sourcing, or localism. Nevertheless, in developed markets like Australia and Singapore, there is an increased inclination towards the consumption of sustainable and ethically sourced cybersecurity products.

Middle East and Africa

Each sub-region has a different set of dynamics in the Middle East and Africa Financial Cybersecurity market. The overall GDP growth is expected to be around 3.5% with inflation at 6%. For instance, in South Africa, a government cybersecurity subsidy is the main factor that determines the uptake of the product. The main channel for financial cybersecurity solutions is through government partnerships, whereas, the fastest-growing channel is direct-to-consumer sales.

Consumers in this region are very much concerned about the environment and ethical sourcing, thus, it becomes a necessity for companies operating in the market to comply with these requirements. Nevertheless, in the case of emerging markets where price and status are the most important things, companies have to compromise between the quality of the product and its price in order to meet the different consumer preferences.

Frequently Asking Questions

What is the Financial Cybersecurity market size and growth forecast?

Financial Cybersecurity Market is predicted to grow from USD 89.32 Billion in 2025 to approximately USD 128.34 Billion by 2034. the industry is estimated to expand at a CAGR of 12.8%.

Who are the key players in the Financial Cybersecurity market?

The Financial Cybersecurity Market Includes Major Companies CrowdStrike, IBM Security, Palo Alto Networks, Fortinet, Inc, Cisco Systems, Inc., Symantec Corporation, Others.

What are the current and future trends for Financial Cybersecurity market?

Current trend: Increasing adoption of AI and machine learning for advanced threat detection in the Financial Cybersecurity market. Future trend: Rising demand for cloud-based security solutions to protect financial institutions against evolving cyber threats.

What are the challenges facing the Financial Cybersecurity market?

One of the challenges facing the Financial Cybersecurity market is the evolving nature of cyber threats and attacks, requiring constant innovation and adaptation to stay ahead.

Which regions dominate the Financial Cybersecurity market?

North America and Europe dominate the Financial Cybersecurity market due to the strong presence of key players, advanced technology adoption, and stringent regulatory requirements.

Report Features

This report gives the most complete information. The report on Financial Cybersecurity Market format has been designed so that it can provide the best value to the business. It offers crucial insights into the market’s dynamic and will aid in strategic decision-making for current players as well as those looking to join the market.

What Deliverables Will You Get in this Report?

Key questions this report answers | Relevant contents in the report |

How big is the sales opportunity? | In-depth analysis of the Global Financial Cybersecurity Market |

How lucrative is the future? | Market forecast and trend data and emerging trends |

Which regions offer the best sales opportunities? | Global, regional and country level historical data and forecasts |

Which are the most attractive Financial Cybersecurity market Key segments? | Market segment analysis and |

Which are the top Key players and Their Financial Cybersecurity market positioning? | Competitive landscape analysis, Market share analysis |

How complex is the business environment? | Porter’s five forces analysis, PEST analysis, Life cycle analysis |

What are the factors affecting the Financial Cybersecurity market? | Drivers & Restraints |

Will I get the information on my | Customized Report as per your Business Needs Our analysts will work directly with you and understand your needs Get data on specified regions or segments, competitor and Vendors Data will be formatted and presented as per your requirements Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us |

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/