Luxury Cosmetics & Beauty Product Market Size, Trends Analysis Research Report By Product Type (Skincare, Haircare, Makeup, Fragrances, Others), by Category (Premium, Ultra-Luxury), by Distribution Channel, by End User, and By Region Global Market Analysis And Forecast, 2025-2034

Nov- 2025 Formats | PDF | Category: Consumer Goods | Delivery: 24 to 72 Hours

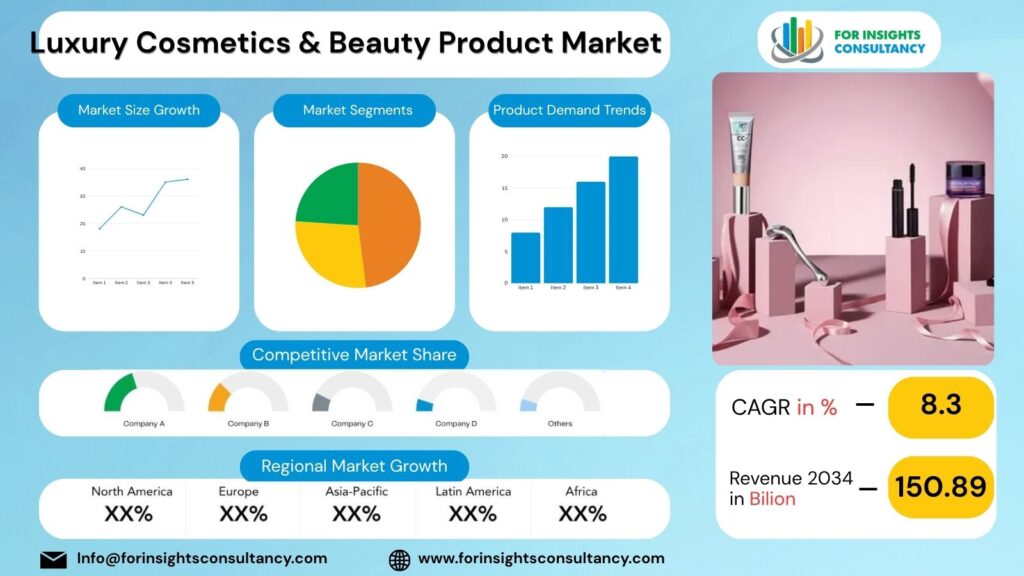

Global revenue from the Luxury Cosmetics & Beauty Product market is anticipated at US$ 79.45 Billion in 2025 and has been blunt to existing at a CAGR of 8.3% to extent US$ 150.89 Billion by the end of 2034.

Luxury Cosmetics & Beauty Product Market Research Summary

The luxury cosmetics and beauty product market is an exciting and constantly changing industry that provides products and experiences of the highest quality to consumers. Consequently, a detailed survey of this market is crucial to grasping its subtleties and future changes.

First of all, the luxury cosmetics and beauty product market is characterized by an ever-growing demand for skincare, makeup, and fragrance products made of the highest quality. The buyers look for luxurious items that offer pure ingredients, novelties in the formulation, and, most importantly, effectiveness. To meet customer needs, brands are innovating in order to combine advanced techniques and eco-friendly measures in their products.

Insightfully, a big trend for the luxury cosmetics and beauty product market has become the increasing demand of personal beauty solutions. Brands use data-driven insights and advanced customization tools in order to meet the needs of their customers better and to surpass their expectations. Be it skincare or makeup, the customers experience is provided with the uniqueness and the individuality of the solution.

As a matter of fact, the luxury cosmetics and beauty product market will be making next moves about sustainability, wellness, and inclusivity. It is brand adopting green packaging, issuing ethically sourced ingredients, marketing diversely that attract the most conscious and diversified consumer base. In addition, there is a rising demand for products that contribute to total well-being and self-love which is a sign of beauty moving to the holistically guided way.

Market Insights

In 2024, the Luxury Cosmetics & Beauty Product Market is projected to see significant growth, with the largest regional revenue share expected to come from the Asia-Pacific region, driven by increasing disposable incomes and a rising beauty-conscious population.

The growth forecast for this region is estimated to be around 8% due to the booming demand for luxury beauty products.

In the U.S., approximately 83% of the population is expected to reside in urban areas by 2024, highlighting the lucrative market potential for luxury cosmetics and beauty products in metropolitan areas.

Within the luxury cosmetics and beauty product market, skincare is anticipated to capture the largest revenue share, followed by fragrance and makeup segments. Consumers are increasingly prioritizing premium skincare products, paving the way for substantial growth opportunities in this segment.

Market Dynamics

Trends

Sustainable Packaging: A demand for sustainable packaging has been created by consumers who are very conscious of the environment and this has caused the luxury brands to take up the challenge of producing biodegradable and recyclable packaging materials as a way of addressing the need.

Personalization and Customization: Beauty brands are using advanced technology to give personalized product recommendations, create bespoke formulations, and offer customized packaging to delight their customers.

Digital Innovation: Beauty retail and online platforms’ integration of augmented reality (AR) and virtual reality (VR) technologies is a game changer in the way consumers can discover, try, and buy luxury cosmetics and beauty products.

Clean Beauty Movement: The demand for clean, natural, and organic beauty products that are free from harmful chemicals is what has caused luxury brands to reformulate their products and take up transparent labeling as a practice.

Inclusive and Diverse Representation: Luxury beauty brands have become more diverse and inclusive by broadening their shade ranges, featuring different models in their advertising campaigns, and encouraging authenticity and representation at all marketing levels.

Growth Drivers

Increasing Demand for Premium Skincare: Skincare has become a priority for consumers, and they are ready to spend on expensive products that contain advanced formulations and innovative ingredients.

Rising Disposable Income: The growing middle class in the developing markets is the main factor behind the demand for luxury cosmetics and beauty products as consumers now have more disposable income to spend on premium items.

Shift Towards Sustainable Beauty: The awareness of sustainability and eco-consciousness, in general, has been the main reason for consumers to buy luxury beauty products that are environmentally friendly and cruelty-free.

Influence of Social Media and Influencers: The social media platforms and beauty influencers have been the major factors in the promotion of luxury cosmetics, the creation of trends, and the influence of consumer preferences in the beauty industry.

Restraints

Economic Uncertainty: Changing macroeconomic conditions may reduce the demand of luxury beauty products by the consumers.

Regulatory Challenges: More and more regulations on cosmetic ingredients and testing of products might cause fewer product launches and sales.

Competition from Emerging Brands: The rise of niche, indie brands that offer unique products may become a threat to established luxury brands.

Sustainability Pressures: As more consumers demand sustainable and eco-friendly beauty products, the company may need to reformulate products extensively and invest more.

Supply Chain Disruptions: If there are disruptions in the supply chain caused by global events or natural disasters, it will result in delays in making products available and distributing them.

Opportunities

Expansion in Developing Countries: Take advantage of the rising consumption of luxury cosmetics and beauty products in developing markets.

Online Transformation: Use digital platforms for marketing, e-commerce, and personalized customer experiences to increase brand visibility and customer interaction.

Consumer-Centric Practices: Implement attractive-for-the-consumer packaging and ingredients to meet the growing consumer demand for environmentally friendly beauty products.

Creative Product Solutions: Allocate funds to research and development for groundbreaking product formulations, textures, and packaging to maintain a competitive edge.

Use of Influencers: Get in touch with influencers and celebrities to get the word out about your brand and access a larger pool of potential customers via social media platforms.

Challenges

Evolving Consumer Preferences: Adapting to the ever-changing demands and preferences of consumers of natural, sustainable, and ethically sourced products.

Increased Competition: Experiencing intense competition from new entrants, indie brands, and cosmetic giants, leading to market saturation.

Supply Chain Disruptions: Handling supply chain disruptions caused by global events such as pandemics, trade disputes, and natural disasters that affect production and distribution.

Rising Costs: Trying to keep up with the escalating costs of raw materials, packaging, and transportation, which affect profit margins and pricing strategies.

Regulatory Compliance: Changing with the times regulations and standards in different regions regarding product safety, testing, and labeling to ensure market compliance and consumer trust.

Luxury Cosmetics & Beauty Product Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- Amorepacific Corporation

- Clarins S.A.

- Chanel S.A.

- Mary Kay Inc.

- Oriflame Holding AG

- L’Oréal S.A.

- The Estée Lauder Companies Inc.

- Shiseido Company, Limited

- LVMH Moët Hennessy Louis Vuitton SE

- Beiersdorf AG

Luxury Cosmetics & Beauty Product Market Company News 2024 and 2025

Clarins S.A

In 2025, Clarins expanded its sustainable packaging initiative and opened a new innovation center in France focused on plant-based beauty formulas.

L’Oréal S.A

Throughout 2024–2025, L’Oréal invested heavily in AI-driven beauty personalization and sustainable product innovation, including biodegradable packaging.

The Estée Lauder Companies Inc

In 2025, the company announced strategic expansion in China’s luxury skincare segment and launched advanced AR-powered virtual try-on platforms.

Mary Kay Inc.

In early 2025, Mary Kay strengthened its European presence through new product lines under its “TimeWise” brand and collaborations with skincare institutes.

Key Segments

Segmentation By Product Type

- Skincare

- Haircare

- Makeup

- Fragrances

- Others

Segmentation By Category

- Premium

- Ultra-Luxury

Segmentation By Distribution Channel

- Online

- Offline (Specialty Stores, Departmental Stores, Boutiques)

Segmentation By End User

- Woman

- Men

- Unisex

Global Geographic Coverage:

The Report Provides In-Depth Qualitative And Quantitative Data On The Luxury Cosmetics & Beauty Product Market For All Of The Regions And Countries Listed Below:

North America

The luxury cosmetics and beauty product market in North America is vibrant with a projected GDP growth of 2.5% and an inflation rate of 2.1%. In the USA, the local, non-replicable driver that influences the market is the rising demand for sustainable and ethically sourced products. This trend is mainly by a higher awareness of the environmental issues and the significance of cruelty-free ingredients.

The leading channel for luxury cosmetics in North America is e-commerce, with online sales rapidly growing. As a result, the specialty beauty stores are the fastest-growing channel due to the personalized shopping experience they provide.

Consumers in North America put sustainability, ethical sourcing, and localism first when buying beauty products. This has resulted in a surge of demand for products that are environmentally friendly, cruelty-free, and help local communities.

Luxury cosmetics brands in emerging markets where price and status are dominant, are concentrating on providing exclusive products and limited editions to meet the needs of the affluent consumer segment.

Europe

The luxury cosmetics and beauty product market in Europe represents a vibrant industry that has a bright future in terms of growth. Local GDP growth and inflation rates are the main factors that influence the market across different sub-regions in Europe, which is indicative of a strong consumer demand for luxury beauty products.

For instance, in France, the main local driver that affects the luxury cosmetics market is definitely the Cannes Film Festival, which helps in creating a buzz around beauty trends and also the usage of premium products. The main channel for luxury cosmetics in France is through high-end department stores, and e-commerce is the next most vibrant channel.

Shoppers in Sweden give top priority to sustainability and ethical sourcing, so it becomes a luxury cosmetics brand’s requirement to be in line with these principles. Meanwhile, in quickly developing markets such as Poland and Romania, prices and status are the two factors that dominate consumer purchasing decisions in the luxury beauty sector.

To sum up, the European luxury cosmetics market has a wealth of possibilities that brands can exploit, keeping in mind that the consumers have different preferences and the market is dynamic in nature, varying from one sub-region to another.

Asia Pacific

For the luxury cosmetics and beauty product market in the Asia Pacific region, GDP growth is expected to be around 5.5%, with inflation at 2.3%. In Japan, one of the main factors that internally drives luxury beauty products is the gift-giving culture, which makes the sales increase during holidays like the New Year. Department stores are the main distribution channel here, while e-commerce is the most rapid channel. Ethical sourcing and sustainability are very important to consumers in Japan.

The local driver in Indonesia is the government initiative to promote local brands, thus having a positive impact on the market. Large supermarket chains are the main channel in Indonesia, while online marketplaces are rapidly developing. Localism and ethical sourcing are the main priorities of consumers here.

In a lot of emerging markets where price and status are the most important, luxury brands have to find a balance between exclusivity and accessibility in order to be attractive to a wider consumer base and at the same time keep their high-end image.

Middle East and Africa

The luxury cosmetics and beauty product market in the Middle East and Africa is set to experience major growth over the next few years. With the region offering a GDP growth of 4.2% and an inflation rate of 2.9%, there are many profitable opportunities for beauty brands to thrive. In Saudi Arabia, the market has been expanded by the government subsidy for locally-produced beauty products, thus, attracting the local consumers towards homegrown brands. The main channel for luxury beauty products in the region is high-end department stores, whereas online retail is the quickest-growing channel.

Consumers in the Middle East and Africa are becoming more and more conscious of sustainability, ethical sourcing, and localism when buying cosmetics and beauty products. This tendency is especially noticeable in emerging markets where price and status still have the most influence on consumer choices. Companies that support these values will probably be able to get a competitive advantage in the market.

Frequently Asking Questions

What is the Luxury Cosmetics & Beauty Product market size and growth forecast?

Luxury Cosmetics & Beauty Product Market is predicted to grow from USD 79.45 Billion in 2025 to approximately USD 150.89 Billion by 2034. the industry is estimated to expand at a CAGR of 8.3%.

Who are the key players in the Luxury Cosmetics & Beauty Product market?

The Luxury Cosmetics & Beauty Product Market Includes Major Companies Amorepacific Corporation, Clarins S.A., Chanel S.A., Mary Kay Inc., Oriflame Holding AG, L’Oréal S.A., The Estée Lauder Companies Inc., Shiseido Company, Limited, LVMH Moët Hennessy Louis Vuitton SE, Beiersdorf AG, Others.

What are the current and future trends for Luxury Cosmetics & Beauty Product market?

Current trend: Shift towards clean and sustainable luxury beauty products.

Future trend: Integration of technology such as AI and AR in personalized beauty solutions.

What are the challenges facing the Luxury Cosmetics & Beauty Product market?

Challenges facing the Luxury Cosmetics & Beauty Product market include increasing competition from new entrants, changing consumer preferences, and the need for sustainable and ethically sourced ingredients.

Which regions dominate the Luxury Cosmetics & Beauty Product market?

Europe and North America dominate the Luxury Cosmetics & Beauty Product market with their high demand for premium and high-end beauty products.

Report Features

This report gives the most complete information. The report on Luxury Cosmetics & Beauty Product Market format has been designed so that it can provide the best value to the business. It offers crucial insights into the market’s dynamic and will aid in strategic decision-making for current players as well as those looking to join the market.

What Deliverables Will You Get in this Report?

Key questions this report answers | Relevant contents in the report |

How big is the sales opportunity? | In-depth analysis of the Global Luxury Cosmetics & Beauty Product Market |

How lucrative is the future? | Market forecast and trend data and emerging trends |

Which regions offer the best sales opportunities? | Global, regional and country level historical data and forecasts |

Which are the most attractive Luxury Cosmetics & Beauty Product market Key segments? | Market segment analysis and |

Which are the top Key players and Their Luxury Cosmetics & Beauty Product market positioning? | Competitive landscape analysis, Market share analysis |

How complex is the business environment? | Porter’s five forces analysis, PEST analysis, Life cycle analysis |

What are the factors affecting the Luxury Cosmetics & Beauty Product market? | Drivers & Restraints |

Will I get the information on my | Customized Report as per your Business Needs Our analysts will work directly with you and understand your needs Get data on specified regions or segments, competitor and Vendors Data will be formatted and presented as per your requirements Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us |

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/