Plastic Films & Sheets Market Growth Analysis Research Report by raw polymer type (LLDPE / LDPE, HDPE, BOPP, CPP,PVC, PA, Specialty polymers, and Others), by Packaging (Food packaging, Consumer goods packaging, Medical & pharmaceutical packaging, Industrial packaging) and by Non-Packaging (Agriculture, Construction, Healthcare, Industrial and others)- Global Forecast to 2034

Jan-2026 Formats | PDF | Category: Chemicals & Materials | Delivery: 24 to 72 Hours

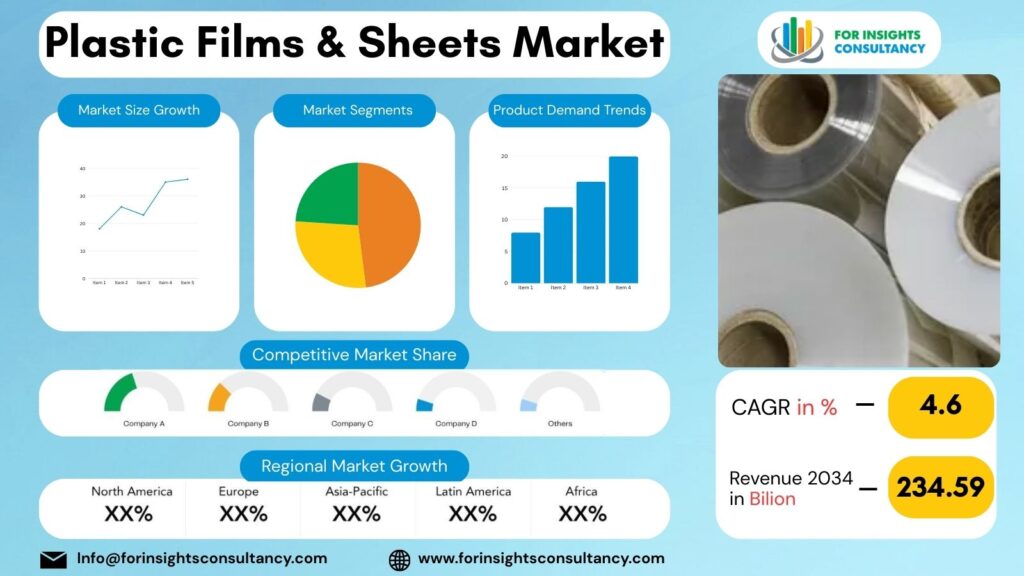

The Global Plastic Films & Sheets Market is estimated to be valued at USD 158.43 Billion in 2025 and is expected to reach USD 234.59 by 2034, growing at a compound annual growth rate (CAGR) of 4.6% from 2026 to 2034.

Plastic Films & Sheets Market: Overview and Growth in the Upcoming Year

The Plastic Films & Sheets Market in 2026 continue to play a vital role in global manufacturing and packaging sectors. Plastic sheets or films are thin and flexible plastic materials. These can be semi-rigid, thick or rigid structures. Plastic films and sheets find use across a range of industries. And include food packaging, healthcare, and agriculture. Further, construction, automotive and consumer goods sectors in particular use plastic manufacturers extensively. Take the polymers like polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), and polyethylene terephthalate (PET). They have high strength, flexibility, light-weight and cheap.

The packaged products market is anticipated to witness steady growth in 2026 due to increasing consumption of packaged products worldwide along with growing industrial activities. Growing disposable incomes, urbanization, and changing lifestyles are leading to an increase in demand for safe and convenient packaging. Flexible packaging formats using plastic films have been preferred over other formats as they provide a strong barrier against moisture, oxygen and contamination.

The food and beverage industry remains the top generator of revenue in the market. Multilayer plastic films are essential for preparing ready-to-eat meals, frozen food, dairy products, snacks, and drinks helping in shelf life extension and freshness maintenance. At the same time, the pharmaceutical and healthcare industries rely on high-quality plastic films and sheets for the needs of sterile packaging, medical device wraps, and protective coverings, further strengthening demand in 2026. Other important growth is agriculture.

Crops, in addition to enhancing yield and product quality, also serve as a shield against climate change and potentially reduce the need for agrochemicals. The global adoption of agricultural sheets is likely to increase in 2021 as government and private stakeholders are expected to invest in modern farming systems for food security.

Market expansion is being driven by technological innovation in 2026. Manufacturers are focusing on advanced extrusion techniques, multilayer structures, and lightweight material development to reduce raw material usage while ensuring performance. Plastic sheets are increasingly being accepted in the construction and industrial sector due to better durability, transparency and heat resistance.

Top Companies Covered In This Report

- Amcor plc

- Berry Global Group, Inc.

- Sealed Air Corporation

- Toray Industries, Inc.

- Jindal Poly Films Ltd.

- Mitsubishi Chemical Corporation

- Uflex Ltd.

- Taghleef Industries

- British Polythene Industries PLC

- Toyobo Co., Ltd.

- Sabic (Saudi Basic Industries Corporation)

- Dow Inc.

- DuPont de Nemours, Inc.

- Novolex Holdings, LLC

- Plastic Film Corporation of America

- BASF SE

- Innovia Films (CCL Industries)

- RKW SE.

Plastic Films & Sheets Industry News

October 24, 2025 Amcor Takes Home a DuPont™ Tyvek® Sustainable Healthcare Packaging Award

Amcor also strengthened its position through a major acquisition of Berry Global in 2025, creating a combined flexible packaging leader with ~$24 billion in revenue, enhancing its global footprint and technological capabilities across plastics films and sheets. Amcor HealthCare has been recognized with the 2025 DuPont™ Tyvek® Sustainable Healthcare Packaging Award for Operational Efficiencies. The award honors Amcor’s development of ACT2100™ Air Peel Technology, an innovative Tyvek® heat seal coating that delivers stronger seals, greater breathability, and improved sterilization performance.

Toray Industries, Inc. & Toyobo Co., Ltd

In late 2025, Toray launched a high-heat-resistant BOPP film for electric vehicle capacitors, showing diversification of film applications beyond traditional packaging. Likewise, Toyobo introduced a BOPP film with 80% recycled content, indicating a move toward sustainability in film materials.

Detailed Segmentation and Classification of the report (Market Size and Forecast – 2034, Y-o-Y growth rate, and CAGR):

Segment By raw polymer type or film/sheet category

- LLDPE / LDPE (Linear/Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- PE films

- BOPP (Biaxially Oriented PP)

- CPP (Cast PP)

- Polyvinyl Chloride (PVC)

- Polyamide (PA) / Nylon

- Others

Segment by Packaging

- Food packaging

- Consumer goods packaging

- Medical & pharmaceutical packaging

- Industrial packaging

Segment by Non-Packaging

- Agriculture

- Construction

- Healthcare

- Industrial and others

Segment by End-User / Industry

- Food & Beverage Industry

- Consumer Goods Industry

- Pharmaceutical & Healthcare Sector

- Automotive & Transportation

- Industrial Equipment & Electronics

- Agriculture & Construction

Segment by Thickness categories

- Below 100 microns

- 100–200 microns

- Above 200 microns (used for distinct performance characteristics)

Segments by Formulation

- Flexible plastic films

- Rigid plastic sheets

- Composite / laminated films

Regional Deep-dive Analysis:

The report provides in-depth qualitative and quantitative data on the Plastic Films & Sheets Market for all of the regions and countries listed below:

North America

United States

In North America, the country with the largest market for plastic films and sheets is the USA, which commands a majority share of regional demand and production. In terms of both volume and value in North America in 2023, the U.S. was by far the largest regional market for Carnitines, with 78 % of market consumption and 72 % of production volume.

Driven by strong packaging demand from food & beverage, healthcare, consumer goods, and e-commerce industries, the U.S. Market will continue to expand in 2025-2026. Flexible materials like LDPE/LLDPE and BOPP are the most widely used products since these have a good barrier property, lightweight, and are cheaper.

Canada

The plastic films and sheets market in Canada is a relatively small segment of the North American market, with strong supply chain linkages to the United States. Demand from food packaging, healthcare and agricultural applications characterizes the country, with demand consumption growth coming from Ontario, Québec, Alberta and British Columbia.

In the years 2025 and 2026, the Canadian marketplace continues to emphasize high-value specialty and sustainable film applications, instead of just commodity volumes. Canada’s adoption of technologies is seeing higher growth than volume, unlike other regions that are seeing growth led by high volume. In particular, there is growth taking place in the use of recyclable film structures, high-barrier packaging films, and advanced laminates that allow increased shelf life and product protection of packed commodities.

Europe

Germany

In Europe, Germany will continue to lead the plastic films and sheets market in the plastic films and sheets industry by the region’s packaging films share of over 21% in 2025. This growth will be largely due to the country’s strong manufacturing and export base. Most of the demand is for demand is met from food packaging, industrial wraps, high-barrier specialty films for automotive, and engineering industries. The country’s strong automation and production technologies favour the manufacture of both high-volume flexible films and engineered sheet products.

The German market is shaped by EU circular economy policies and stringent recycling objectives in terms of regulatory and sustainability drivers. Considerable investment appears to be going into recyclable mono-material films, high PCR products, and sustainable BOPP/LDPE options. Firms are adopting recycling technologies and introducing barrier enhancements to conform to the PPWR and EU Green Deal directives.

France

France is a major European consumer of plastic films and sheets, with approximately 2.9 million tons of imports in 2024, reflecting its robust usage in food, consumer goods, and luxury packaging segments. The French market favors flexible films for food and beverage packaging, particularly for fresh and processed foods, premium wine & cheese packaging, and retail consumer products. The healthcare and pharmaceutical segments also contribute modest but growing demand for specialized film types.

Sustainability & Regulation: France is deeply influenced by EU recycling standards and national plastic waste policies. Growth in recyclable mono-material films and bio-based alternatives is strong, with investment in circular economy solutions and industrial recycling infrastructure.

Italy

Italy ranks among the fastest-growing European countries for plastic films & sheets, with flexible packaging demand expanding in food, pharmaceuticals, and industrial applications. Italian consumption is supported by strong export volumes in processed foods and consumer goods.

Italy was one of Europe’s largest consuming markets for plastic plates, sheets, films, foil and strip, with imports at 813 K tons in 2024, reflecting broad usage across packaging and industrial sectors.

Spain

Spain is among the leading importers of plastic films and sheets in Europe, with imports at 613 K tons in 2024, indicating rising utilization across packaging, industrial and consumer sectors.

Spain shows notable growth due to expanding food processing, agriculture exports, and retail packaging demand. Regions such as Valencia and Catalonia have seen recent expansions in pouch and shrink film production lines.

Asia-Pacific

China

China is the largest and fastest-growing plastic films and sheets market in Asia-Pacific, accounting for a substantial share of regional demand due to its vast manufacturing base and packaging sector. The country’s rapid industrialization and expanding consumer goods markets drive high film consumption.

Packaging remains the dominant segment, especially food & beverage, personal care, healthcare, and e-commerce packaging. China’s booming online retail ecosystem increases demand for protective, flexible films that are lightweight yet durable. Films like LDPE, LLDPE, and BOPP are widely used for pouches, wraps, and barrier packaging.

India

India is a rapidly expanding market for plastic films and sheets, underpinned by strong demand in food packaging, FMCG, healthcare, and retail sectors. Urbanization and rising disposable incomes are driving consumption of packaged goods, which in turn boosts film demand.

India’s film market is expected to grow strongly through 2026, driven by the expanding packaging industry, infrastructure development, and investments in sustainable materials. Local manufacturers and global suppliers are increasing production and technology partnerships to capture this growth.

Japan

Japan represents a mature and technologically advanced market for plastic films and sheets. While growth rates are moderate compared to China and India, Japan excels in high-performance, specialty films used in electronics, automotive, and premium packaging.

Japanese manufacturers lead in materials innovation, including high-barrier films, heat-resistant sheets, and functional films for electronic applications. Meanwhile, strong environmental regulations have accelerated adoption of recyclable and bio-based films. Companies are also pioneering chemical recycling and closed-loop packaging solutions.

While mature, Japan’s market is expected to maintain stable demand, led by premium and technical film segments, and supported by ongoing sustainability initiatives and industrial application growth.

South Korea

South Korea’s plastic films and sheets market is innovation-driven, leveraging advanced manufacturing and material science capabilities. Strong automotive, electronics and packaging industries support healthy demand for specialized film products. The government’s circular economy policies and extended producer responsibility frameworks have encouraged recyclable mono-material films and increased use of recycled content. Sustainable packaging materials are increasingly adopted by major brands.

South Korea’s market is projected to grow steadily with a focus on value-added and high-tech films rather than simple volume increases. Strong R&D investments support advancements in film functionality and recyclability.

Middle East and Africa

Saudi Arabia

Saudi Arabia is a key contributor to the Middle East Plastic Films & Sheets Market due to its strong petrochemical industry and downstream processing. As one of the largest producers of base polymers like polyethylene (PE) and polypropylene (PP), the country supports a significant local supply of films and sheets for regional use.

Fast-growing sectors such as food & beverage packaging, retail consumer goods, pharmaceuticals, and construction drive demand for plastic films. Flexible films (LDPE, LLDPE, BOPP) are widely used for pouches, shrink films, laminates, and protective packaging. Sheets are deployed in rigid packaging, industrial liners, and agricultural coverings.

2025–2026 Outlook: Demand is expected to grow moderately as the country expands its food processing, retail, and construction activities. Investment in local manufacturing capacity and export opportunities to neighboring GCC countries will support market expansion. Sustainability and recycling initiatives will gain emphasis as regulations evolve.

South Africa

South Africa is the largest plastic film market in Sub-Saharan Africa, supported by its advanced food processing, retail packaging, and manufacturing sectors. Flexible films (PE, BOPP, PET) dominate usage, particularly in consumer goods, food packaging, and industrial protective films.

With higher urbanization rates and organized retail penetration, South African brands increasingly adopt flexible film packaging for perishables, snacks, and household products. Film production and conversion technologies are relatively well-established compared with other African markets.

South Africa has one of the most developed recycling industries in Africa, with established collection and film recycling operations. Industry bodies and extended producer responsibility policies are pushing higher recycled content and recyclable film adoption. Brands are transitioning toward mono-material and PCR-rich films to enhance recyclability.

2025–2026 Outlook: South Africa’s film market is expected to maintain steady growth. Sustainability and regulatory frameworks, particularly around waste diversion and circular economy principles, will increasingly influence product development and material selection.

Frequently Asked Questions with Answers

What is the Plastic Films & Sheets market size and growth forecast?

Plastic Films & Sheets Market is projected to reach a value of USD 158.43 billion in 2025 and is anticipated to grow to approximately USD 234.59 billion by 2034. This expansion reflects a compound annual growth rate (CAGR) of 4.6% during the forecast period from 2026 to 2034, driven by increasing demand across packaging, industrial, and agricultural applications.

Who are the key players in the Plastic Films & Sheets market?

The Plastic Films & Sheets Market Includes Major Companies Saudi Basic Industries Corporation (SABIC), Toyobo Co. Ltd, British Polythene Industries Plc, The Dow Company, DuPont, Toray Industries, Inc., Berry Global, Inc., Plastic Film Corporation of America, Bemis Company, Inc., Sealed Air Corporation, Uflex Ltd, Amcor Plc, Others.

What are the current and future trends for Plastic Films & Sheets market?

Current and future trends in the Plastic Films & Sheets market include increasing demand for sustainable, recyclable and high-performance films, driven by packaging growth, environmental regulations, and technological innovation.

Which regions dominate the Plastic Films & Sheets market?

Asia-Pacific is the leading region dominating the Plastic Films & Sheets market.

Key insights provided by the report that could help you take critical strategic decisions?

- Regional reports analyse product/service consumption and market factors in each region.

- Reports highlight possibilities and dangers for suppliers in the Plastic Films & Sheets Market business globally.

- The report identifies regions and sectors with the highest growth potential.

- It provides a competitive market ranking of major companies, as well as information on new product launches, partnerships, business expansions, and acquisitions.

- The report includes a comprehensive corporate profile with company overviews, insights, product benchmarks, and SWOT analysis for key market participants.

Customization: We can provide following things

1) On request more company profiles (competitors)

2) Data about particular country or region

3) We will incorporate the same with no additional cost (Post conducting feasibility).

Any Requirement Contact us: https://www.forinsightsconsultancy.com/contact-us/

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/