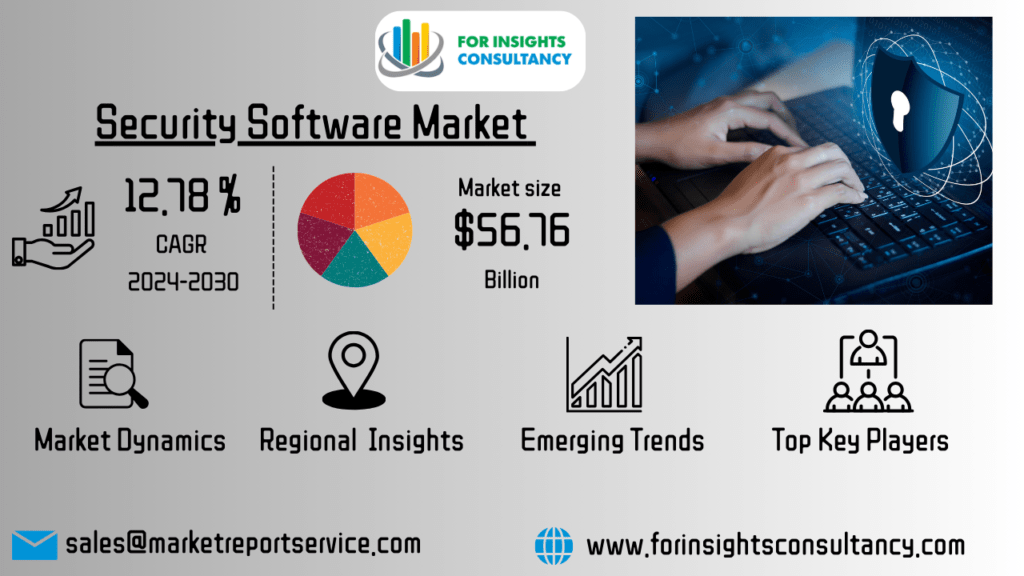

Security Software Market Trend Analysis Research Report by Type (Mobile Security Software, Consumer Security Software, Enterprise Security Software) and by End User (Large Enterprises, Government Agencies, Bfsi, Others): Global Opportunity Analysis and Industry Forecast, 2024-2030

Pages: 123 | Jan-2024 Formats | PDF | Category: Information and Technology | Delivery: 24 to 72 Hours

Security Software Market Outlook 2024 to 2030

Security Software Market size was valued at US$ 22.78 Billion. in 2023 and the total Security Software revenue is expected to grow at CAGR 12.78 % from 2024 to 2030, reaching nearly US$ 56.76 Billion.

Security software enhances information and corporate security by protecting against various hazards like hackers, spyware, viruses, and malware.

Due to the complexity and diversity of cyber threats, as well as the increasing number of endpoints requiring protection due to mobility, remote work, and the Internet of Things, businesses are increasingly relying on sophisticated security software solutions.

Companies use security software from up to 50 providers, and a security platform can simplify and cost-effectively manage these programs. It offers multiple product unification, workflow automation across endpoints, networks, cloud, and applications, facilitates intelligence sharing, and improves threat visibility. This enables faster, more cooperative operation of security teams, leading to better results.

A security appliance is a device or server that prevents unwanted network traffic from entering. Types of security appliances include:

devices that detect intrusions into networks and can notify security teams of potential dangers.

Email security appliances are devices that can identify and block email threats like spam and malware.

UTM appliances, which perform tasks like content filtering, intrusion detection, and antivirus, enable organizations to manage multiple security capabilities from a single vendor using a single console.

Segment Analysis

Security and anti-malware

description: Software designed to identify, stop and eliminate malicious software which includes worms, viruses and other forms of malware.

Market Relevance: Fundamental for basic cybersecurity, frequently included in larger security suites.

Security Software for Firewalls:

Description: Controls and monitors the network’s traffic incoming and outgoing in accordance with predetermined security guidelines and acts as a firewall between a secure internal network and external networks that are not trusted.

Market Relevance: Essential for network security, particularly in the fight against an unauthorized access.

Identification and Access Management (IAM):

Description: Manages digital identities as well as authentication and access rights. It also offers solutions for single sign-on (SSO) along with multi-factor authentication.

Market Significance Important to ensure that only authorized persons have access to certain resources.

Software for encryption:

Description: Protects data by making it an algorithm that can only be read by authorized persons. It is used to protect sensitive data both in transit and while it is being transmitted.

Market Relevance: Essential for data security in compliance with privacy laws.

Who are Security Software Market Key Players?

Major players operating in this industry include Symantec Corporation, Intel Corporation, IBM, Dell Inc., Trend Micro Incorporated, Cisco Systems, Imperva, AVG Technologies, F-Secure Corporation along with Panda Security.

New Developments

Nov 7, 2023 IBM Unveils Cloud-Native SIEM Built to Maximize Security Teams’ Time and Talent

IBM announced a major evolution of its flagship IBM QRadar SIEM product: redesigned on a new cloud-native architecture, built specifically for hybrid cloud scale, speed and flexibility. IBM also unveiled plans for delivering generative AI capabilities within its threat detection and response portfolio – leveraging watsonx, the company’s enterprise-ready data and AI platform.

Aug. 8, 2019 Broadcom to Acquire Symantec Enterprise Security Business for $10.7 Billion in Cash

Broadcom, Inc., a global technology leader that designs, develops and supplies semiconductor and infrastructure software solutions, today announced an agreement to acquire the enterprise security business of Symantec Corporation for $10.7 billion in cash. The addition of Symantec’s enterprise security portfolio will significantly expand Broadcom’s infrastructure software footprint as it continues to build one of the world’s leading infrastructure technology companies.

Recent Trends

Zero Trust Security Model– It emphasizes the need for strict identification verification of everyone trying to gain access to resources, in or out of the network.

AI as well as Machine Learning Integration: Increased the use of AI to detect threats and response, improving the ability to recognize and combat the threat of evolving.

Managed Security Services– Rapid growth in the use outsourced security services that oversee and manage security infrastructure.

Growth Drivers

here are some key growth drivers for the security software market:

The Rise of Cybersecurity Risks

The ever-changing evolution and sophistication of cyber-attacks, such as ransomware, malware as well as phishing attacks as well as Advanced persistent threat (APTs) are driving the need for more advanced cybersecurity software.

An Increased Rate of Cyberattacks

The rising rate of cyberattacks targeting businesses across industries has led to a greater awareness of the cybersecurity risks. This is, in turn, arouses the demand for security tools to protect against different attack methods.

digital Transformation as well as IoT adoption

The current digital transformation that is taking place across industries and the widespread use of Internet of Things (IoT) devices create new risks. Security software is vital to protect interconnected systems and devices.

The Remote Work Industry Trends

The increase in remote work, which is accelerated by global events, such as the COVID-19 epidemic, has increased the risk of attack. Secure access and endpoint security solutions are vital to safeguard devices that aren’t part of the traditional network of a company.

Stringent Regulatory Compliance:

More stringent regulatory requirements pertaining to privacy and data protection (e.g. GDPR and CCPA) make it mandatory for companies to install security tools for compliance, and to avoid any legal penalties.

Cloud Adoption and Security Problems:

The wide-spread adoption of cloud-based services requires special Cloud security services. Businesses require robust security tools to safeguard the data and applications that are hosted within cloud-based environments.

Regional Outlook

The analysis of regional regions in the market for security software is affected by many aspects, such as economic growth as well as the regulatory landscape, technology adoption, and maturity in cybersecurity. Here are some suggestions for regional analysis within the market for security software:

The growth of cybersecurity in North America is driven by high technological adoption, a strong regulatory environment, and numerous cybersecurity incidents.

Key markets include the US and Canada. Europe is driven by data privacy and compliance, increased awareness of cybersecurity threats, and growing digitalization.

Asia-Pacific is driven by rapid economic development and digital transformation, increasing cybersecurity awareness, and expanding IT infrastructure. Latin America is driven by growing internet penetration and emerging economies focusing on technology adoption.

Middle East and Africa are driven by increasing reliance on digital technologies, diversification efforts, and rising cybersecurity awareness.

Segments Covered in the Security Software Market

Security Software Market by Type

- Mobile Security Software

- Consumer Security Software

- Enterprise Security Software

Security Software Market by End User

- Large Enterprises

- Government Agencies

- BFSI

- Others

Frequently asked questions

What is security software, and what does it aim to protect against?

Security software is a set of programs designed to safeguard computer networks, systems, and data from various online threats, including ransomware, phishing, and malware, ensuring data availability, confidentiality, and integrity.

What are the key components or types of security software in the market?

Security software includes essential components like antivirus, firewalls, IAM, encryption, endpoint security, SIEM, network, cloud, mobile, and biometric security.

How is the security software market expected to grow in the coming years?

The security software market is expected to grow due to factors such as data protection requirements, remote work, increasing cyber threats, and the increasing use of digital technologies.

What role does artificial intelligence (AI) play in security software?

AI integration in security software enhances threat detection and response capabilities, enabling real-time analysis of trends and abnormalities, enabling easier identification and countering of new cyber threats.

Table of Content

Chapter 1: Introduction

1.1. Report Description

1.2. Key Market Segments

1.3. Key Benefits

1.4. Research Methodology

1.4.1. Primary Research

1.4.2. Secondary Research

1.4.3. Analyst Tools And Models

Chapter 2: Executive Summary

2.1. Cxo Perspective

Chapter 3: Market Landscape

3.1. Market Definition And Scope

3.2. Key Findings

3.2.1. Top Investment Pockets

3.2.2. Top Winning Strategies

3.3. Porter’s Five Forces Analysis

3.3.1. Bargaining Power Of Suppliers

3.3.2. Threat Of New Entrants

3.3.3. Threat Of Substitutes

3.3.4. Competitive Rivalry

3.3.5. Bargaining Power Among Buyers

3.5. Market Dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunities

Chapter 4: Security Software Market, By Type

4.1. Market Overview

4.1.1 Market Size And Forecast, By Type

4.2. Mobile Security Software

4.2.1. Key Market Trends, Growth Factors And Opportunities

4.2.2. Market Size And Forecast, By Region

4.2.3. Market Share Analysis, By Country

4.3. Consumer Security Software

4.3.1. Key Market Trends, Growth Factors And Opportunities

4.3.2. Market Size And Forecast, By Region

4.3.3. Market Share Analysis, By Country

4.4. Enterprise Security Software

4.4.1. Key Market Trends, Growth Factors And Opportunities

4.4.2. Market Size And Forecast, By Region

4.4.3. Market Share Analysis, By Country

Chapter 5: Security Software Market, By End User

5.1. Market Overview

5.1.1 Market Size And Forecast, By End User

5.2. Large Enterprises

5.2.1. Key Market Trends, Growth Factors And Opportunities

5.2.2. Market Size And Forecast, By Region

5.2.3. Market Share Analysis, By Country

5.3. Government Agencies

5.3.1. Key Market Trends, Growth Factors And Opportunities

5.3.2. Market Size And Forecast, By Region

5.3.3. Market Share Analysis, By Country

5.4. Bfsi

5.4.1. Key Market Trends, Growth Factors And Opportunities

5.4.2. Market Size And Forecast, By Region

5.4.3. Market Share Analysis, By Country

5.5. Others

5.5.1. Key Market Trends, Growth Factors And Opportunities

5.5.2. Market Size And Forecast, By Region

5.5.3. Market Share Analysis, By Country

Chapter 6: Security Software Market, By Region

6.1. Market Overview

6.1.1 Market Size And Forecast, By Region

6.2. North America

6.2.1. Key Market Trends And Opportunities

6.2.2. Market Size And Forecast, By Type

6.2.3. Market Size And Forecast, By End User

6.2.4. Market Size And Forecast, By Country

6.2.5. U.S.

6.2.5.1 Market Size And Forecast, Type

6.2.5.2 Market Size And Forecast, End User

6.2.6. Canada

6.2.6.1 Market Size And Forecast, Type

6.2.6.2 Market Size And Forecast, End User

6.2.7. Mexico

6.2.7.1 Market Size And Forecast, Type

6.2.7.2 Market Size And Forecast, End User

6.3. Europe

6.3.1. Key Market Trends And Opportunities

6.3.2. Market Size And Forecast, By Type

6.3.3. Market Size And Forecast, By End User

6.3.4. Market Size And Forecast, By Country

6.3.5. France

6.3.5.1 Market Size And Forecast, Type

6.3.5.2 Market Size And Forecast, End User

6.3.6. Germany

6.3.6.1 Market Size And Forecast, Type

6.3.6.2 Market Size And Forecast, End User

6.3.7. Italy

6.3.7.1 Market Size And Forecast, Type

6.3.7.2 Market Size And Forecast, End User

6.3.8. Spain

6.3.8.1 Market Size And Forecast, Type

6.3.8.2 Market Size And Forecast, End User

6.3.9. Uk

6.3.9.1 Market Size And Forecast, Type

6.3.9.2 Market Size And Forecast, End User

6.3.10. Russia

6.3.10.1 Market Size And Forecast, Type

6.3.10.2 Market Size And Forecast, End User

6.3.11. Rest Of Europe

6.3.11.1 Market Size And Forecast, Type

6.3.11.2 Market Size And Forecast, End User

6.4. Asia-Pacific

6.4.1. Key Market Trends And Opportunities

6.4.2. Market Size And Forecast, By Type

6.4.3. Market Size And Forecast, By End User

6.4.4. Market Size And Forecast, By Country

6.4.5. China

6.4.5.1 Market Size And Forecast, Type

6.4.5.2 Market Size And Forecast, End User

6.4.6. Japan

6.4.6.1 Market Size And Forecast, Type

6.4.6.2 Market Size And Forecast, End User

6.4.7. India

6.4.7.1 Market Size And Forecast, Type

6.4.7.2 Market Size And Forecast, End User

6.4.8. South Korea

6.4.8.1 Market Size And Forecast, Type

6.4.8.2 Market Size And Forecast, End User

6.4.9. Australia

6.4.9.1 Market Size And Forecast, Type

6.4.9.2 Market Size And Forecast, End User

6.4.10. Thailand

6.4.10.1 Market Size And Forecast, Type

6.4.10.2 Market Size And Forecast, End User

6.4.11. Malaysia

6.4.11.1 Market Size And Forecast, Type

6.4.11.2 Market Size And Forecast, End User

6.4.12. Indonesia

6.4.12.1 Market Size And Forecast, Type

6.4.12.2 Market Size And Forecast, End User

6.4.13. Rest Of Asia Pacific

6.4.13.1 Market Size And Forecast, Type

6.4.13.2 Market Size And Forecast, End User

6.5. Lamea

6.5.1. Key Market Trends And Opportunities

6.5.2. Market Size And Forecast, By Type

6.5.3. Market Size And Forecast, By End User

6.5.4. Market Size And Forecast, By Country

6.5.5. Brazil

6.5.5.1 Market Size And Forecast, Type

6.5.5.2 Market Size And Forecast, End User

6.5.6. South Africa

6.5.6.1 Market Size And Forecast, Type

6.5.6.2 Market Size And Forecast, End User

6.5.7. Saudi Arabia

6.5.7.1 Market Size And Forecast, Type

6.5.7.2 Market Size And Forecast, End User

6.5.8. Uae

6.5.8.1 Market Size And Forecast, Type

6.5.8.2 Market Size And Forecast, End User

6.5.9. Argentina

6.5.9.1 Market Size And Forecast, Type

6.5.9.2 Market Size And Forecast, End User

6.5.10. Rest Of Lamea

6.5.10.1 Market Size And Forecast, Type

6.5.10.2 Market Size And Forecast, End User

Chapter 7: Competitive Landscape

7.1. Introduction

7.2. Top Winning Strategies

7.3. Product Mapping Of Top 10 Player

7.4. Competitive Dashboard

7.5. Competitive Heatmap

7.6. Top Player Positioning,2023

Chapter 8: Company Profiles

8.1. Symantec Corporation

8.1.1. Company Overview

8.1.2. Key Executives

8.1.3. Company Snapshot

8.1.4. Operating Business Segments

8.1.5. Product Portfolio

8.1.6. Business Performance

8.1.7. Key Strategic Moves And Developments

8.2. Intel Corporation

8.2.1. Company Overview

8.2.2. Key Executives

8.2.3. Company Snapshot

8.2.4. Operating Business Segments

8.2.5. Product Portfolio

8.2.6. Business Performance

8.2.7. Key Strategic Moves And Developments

8.3. IBM

8.3.1. Company Overview

8.3.2. Key Executives

8.3.3. Company Snapshot

8.3.4. Operating Business Segments

8.3.5. Product Portfolio

8.3.6. Business Performance

8.3.7. Key Strategic Moves And Developments

8.4. Dell Inc.

8.4.1. Company Overview

8.4.2. Key Executives

8.4.3. Company Snapshot

8.4.4. Operating Business Segments

8.4.5. Product Portfolio

8.4.6. Business Performance

8.4.7. Key Strategic Moves And Developments

8.5. Trend Micro Incorporated

8.5.1. Company Overview

8.5.2. Key Executives

8.5.3. Company Snapshot

8.5.4. Operating Business Segments

8.5.5. Product Portfolio

8.5.6. Business Performance

8.5.7. Key Strategic Moves And Developments

8.6. Cisco Systems

8.6.1. Company Overview

8.6.2. Key Executives

8.6.3. Company Snapshot

8.6.4. Operating Business Segments

8.6.5. Product Portfolio

8.6.6. Business Performance

8.6.7. Key Strategic Moves And Developments

8.7. Imperva

8.7.1. Company Overview

8.7.2. Key Executives

8.7.3. Company Snapshot

8.7.4. Operating Business Segments

8.7.5. Product Portfolio

8.7.6. Business Performance

8.7.7. Key Strategic Moves And Developments

8.8. Avg Technologies

8.8.1. Company Overview

8.8.2. Key Executives

8.8.3. Company Snapshot

8.8.4. Operating Business Segments

8.8.5. Product Portfolio

8.8.6. Business Performance

8.8.7. Key Strategic Moves And Developments

8.9. F-Secure Corporation.

8.9.1. Company Overview

8.9.2. Key Executives

8.9.3. Company Snapshot

8.9.4. Operating Business Segments

8.9.5. Product Portfolio

8.9.6. Business Performance

8.9.7. Key Strategic Moves And Developments

8.10. Panda Security

8.10.1. Company Overview

8.10.2. Key Executives

8.10.3. Company Snapshot

8.10.4. Operating Business Segments

8.10.5. Product Portfolio

8.10.6. Business Performance

8.10.7. Key Strategic Moves And Developments

List of Tables

Table 1. Global Security Software Market, By Type, 2023-2030 ($Million)

Table 2. Security Software Market For Mobile Security Software, By Region, 2023-2030 ($Million)

Table 3. Security Software Market For Consumer Security Software, By Region, 2023-2030 ($Million)

Table 4. Security Software Market For Enterprise Security Software, By Region, 2023-2030 ($Million)

Table 5. Global Security Software Market, By End User, 2023-2030 ($Million)

Table 6. Security Software Market For Large Enterprises, By Region, 2023-2030 ($Million)

Table 7. Security Software Market For Government Agencies, By Region, 2023-2030 ($Million)

Table 8. Security Software Market For Bfsi, By Region, 2023-2030 ($Million)

Table 9. Security Software Market For Others, By Region, 2023-2030 ($Million)

Table 10. Security Software Market, By Region, 2023-2030 ($Million)

Table 11. North America Security Software, By Type, 2023-2030 ($Million)

Table 12. North America Security Software, By End User, 2023-2030 ($Million)

Table 13. North America Security Software, By Country, 2023-2030 ($Million)

Table 14. U.S. Security Software, By Type, 2023-2030 ($Million)

Table 15. U.S. Security Software, By End User, 2023-2030 ($Million)

Table 16. Canada Security Software, By Type, 2023-2030 ($Million)

Table 17. Canada Security Software, By End User, 2023-2030 ($Million)

Table 18. Mexico Security Software, By Type, 2023-2030 ($Million)

Table 19. Mexico Security Software, By End User, 2023-2030 ($Million)

Table 20. Europe Security Software, By Type, 2023-2030 ($Million)

Table 21. Europe Security Software, By End User, 2023-2030 ($Million)

Table 22. Europe Security Software, By Country, 2023-2030 ($Million)

Table 23. France Security Software, By Type, 2023-2030 ($Million)

Table 24. France Security Software, By End User, 2023-2030 ($Million)

Table 25. Germany Security Software, By Type, 2023-2030 ($Million)

Table 26. Germany Security Software, By End User, 2023-2030 ($Million)

Table 27. Italy Security Software, By Type, 2023-2030 ($Million)

Table 28. Italy Security Software, By End User, 2023-2030 ($Million)

Table 29. Spain Security Software, By Type, 2023-2030 ($Million)

Table 30. Spain Security Software, By End User, 2023-2030 ($Million)

Table 31. Uk Security Software, By Type, 2023-2030 ($Million)

Table 32. Uk Security Software, By End User, 2023-2030 ($Million)

Table 33. Russia Security Software, By Type, 2023-2030 ($Million)

Table 34. Russia Security Software, By End User, 2023-2030 ($Million)

Table 35. Rest Of Europe Security Software, By Type, 2023-2030 ($Million)

Table 36. Rest Of Europe Security Software, By End User, 2023-2030 ($Million)

Table 37. Asia-Pacific Security Software, By Type, 2023-2030 ($Million)

Table 38. Asia-Pacific Security Software, By End User, 2023-2030 ($Million)

Table 39. Asia-Pacific Security Software, By Country, 2023-2030 ($Million)

Table 40. China Security Software, By Type, 2023-2030 ($Million)

Table 41. China Security Software, By End User, 2023-2030 ($Million)

Table 42. Japan Security Software, By Type, 2023-2030 ($Million)

Table 43. Japan Security Software, By End User, 2023-2030 ($Million)

Table 44. India Security Software, By Type, 2023-2030 ($Million)

Table 45. India Security Software, By End User, 2023-2030 ($Million)

Table 46. South Korea Security Software, By Type, 2023-2030 ($Million)

Table 47. South Korea Security Software, By End User, 2023-2030 ($Million)

Table 48. Australia Security Software, By Type, 2023-2030 ($Million)

Table 49. Australia Security Software, By End User, 2023-2030 ($Million)

Table 50. Thailand Security Software, By Type, 2023-2030 ($Million)

Table 51. Thailand Security Software, By End User, 2023-2030 ($Million)

Table 52. Malaysia Security Software, By Type, 2023-2030 ($Million)

Table 53. Malaysia Security Software, By End User, 2023-2030 ($Million)

Table 54. Indonesia Security Software, By Type, 2023-2030 ($Million)

Table 55. Indonesia Security Software, By End User, 2023-2030 ($Million)

Table 56. Rest Of Asia Pacific Security Software, By Type, 2023-2030 ($Million)

Table 57. Rest Of Asia Pacific Security Software, By End User, 2023-2030 ($Million)

Table 58. Lamea Security Software, By Type, 2023-2030 ($Million)

Table 59. Lamea Security Software, By End User, 2023-2030 ($Million)

Table 60. Lamea Security Software, By Country, 2023-2030 ($Million)

Table 61. Brazil Security Software, By Type, 2023-2030 ($Million)

Table 62. Brazil Security Software, By End User, 2023-2030 ($Million)

Table 63. South Africa Security Software, By Type, 2023-2030 ($Million)

Table 64. South Africa Security Software, By End User, 2023-2030 ($Million)

Table 65. Saudi Arabia Security Software, By Type, 2023-2030 ($Million)

Table 66. Saudi Arabia Security Software, By End User, 2023-2030 ($Million)

Table 67. Uae Security Software, By Type, 2023-2030 ($Million)

Table 68. Uae Security Software, By End User, 2023-2030 ($Million)

Table 69. Argentina Security Software, By Type, 2023-2030 ($Million)

Table 70. Argentina Security Software, By End User, 2023-2030 ($Million)

Table 71. Rest Of Lamea Security Software, By Type, 2023-2030 ($Million)

Table 72. Rest Of Lamea Security Software, By End User, 2023-2030 ($Million)

Table 73. Symantec Corporation: Key Executives

Table 74. Symantec Corporation: Company Snapshot

Table 75. Symantec Corporation: Operating Segments

Table 76. Symantec Corporation: Product Portfolio

Table 77. Symantec Corporation: Key Strategic Moves and Developments

Table 78. Intel Corporation: Key Executives

Table 79. Intel Corporation: Company Snapshot

Table 80. Intel Corporation: Operating Segments

Table 81. Intel Corporation: Product Portfolio

Table 82. Intel Corporation: Key Strategic Moves And Developments

Table 83. IBM: Key Executives

Table 84. IBM: Company Snapshot

Table 85. IBM: Operating Segments

Table 86. IBM: Product Portfolio

Table 87. IBM: Key Strategic Moves And Developments

Table 88. Dell Inc.: Key Executives

Table 89. Dell Inc.: Company Snapshot

Table 90. Dell Inc.: Operating Segments

Table 91. Dell Inc.: Product Portfolio

Table 92. Dell Inc.: Key Strategic Moves and Developments

Table 93. Trend Micro Incorporated: Key Executives

Table 94. Trend Micro Incorporated: Company Snapshot

Table 95. Trend Micro Incorporated: Operating Segments

Table 96. Trend Micro Incorporated: Product Portfolio

Table 97. Trend Micro Incorporated: Key Strategic Moves And Developments

Table 98. Cisco Systems: Key Executives

Table 99. Cisco Systems: Company Snapshot

Table 100. Cisco Systems: Operating Segments

Table 101. Cisco Systems: Product Portfolio

Table 102. Cisco Systems: Key Strategic Moves And Developments

Table 103. Imperva: Key Executives

Table 104. Imperva: Company Snapshot

Table 105. Imperva: Operating Segments

Table 106. Imperva: Product Portfolio

Table 107. Imperva: Key Strategic Moves And Developments

Table 108. Avg Technologies: Key Executives

Table 109. Avg Technologies: Company Snapshot

Table 110. Avg Technologies: Operating Segments

Table 111. Avg Technologies: Product Portfolio

Table 112. Avg Technologies: Key Strategic Moves And Developments

Table 113. F-Secure Corporation.: Key Executives

Table 114. F-Secure Corporation.: Company Snapshot

Table 115. F-Secure Corporation.: Operating Segments

Table 116. F-Secure Corporation.: Product Portfolio

Table 117. F-Secure Corporation.: Key Strategic Moves And Developments

Table 118. Panda Security: Key Executives

Table 119. Panda Security: Company Snapshot

Table 120. Panda Security: Operating Segments

Table 121. Panda Security: Product Portfolio

Table 122. Panda Security: Key Strategic Moves and Developments

List of Figures

Figure 1. Global Security Software Market Segmentation

Figure 2. Global Security Software Market

Figure 3. Segmentation Security Software Market

Figure 4. Top Investment Pocket In Security Software Market

Figure 5. Moderate Bargaining Power of Buyers

Figure 6. Moderate Bargaining Power Of Suppliers

Figure 7. Moderate Threat Of New Entrants

Figure 8. Low Threat Of Substitution

Figure 9. High Competitive Rivalry

Figure 10. Opportunities, Restraints and Drivers: Global security Software Market

Figure 11. Security Software Market Segmentation, By Type

Figure 12. Security Software Market For Mobile Security Software, By Country, 2023-2030 ($Million)

Figure 13. Security Software Market For Consumer Security Software, By Country, 2023-2030 ($Million)

Figure 14. Security Software Market For Enterprise Security Software, By Country, 2023-2030 ($Million)

Figure 15. Security Software Market Segmentation, By End User

Figure 16. Security Software Market For Large Enterprises, By Country, 2023-2030 ($Million)

Figure 17. Security Software Market For Government Agencies, By Country, 2023-2030 ($Million)

Figure 18. Security Software Market For Bfsi, By Country, 2023-2030 ($Million)

Figure 19. Security Software Market For Others, By Country, 2023-2030 ($Million)

Figure 20. Top Winning Strategies, By Year, 2019-2023*

Figure 21. Top Winning Strategies, By Development, 2019-2023*

Figure 22. Top Winning Strategies, By Company, 2019-2023*

Figure 23. Product Mapping Of Top 10 Players

Figure 24. Competitive Dashboard

Figure 25. Competitive Heatmap: Security Software Market

Figure 26. Top Player Positioning,2023

Figure 27. Symantec Corporation: Net Sales, 2019-2023 ($Million)

Figure 28. Symantec Corporation: Revenue Share, By Segment, 2030

Figure 29. Symantec Corporation: Revenue Share, By Region, 2030

Figure 30. Intel Corporation: Net Sales, 2019-2023 ($Million)

Figure 31. Intel Corporation: Revenue Share, By Segment, 2030

Figure 32. Intel Corporation: Revenue Share, By Region, 2030

Figure 33. IBM: Net Sales, 2019-2023 ($Million)

Figure 34. IBM: Revenue Share, By Segment, 2030

Figure 35. IBM: Revenue Share, By Region, 2030

Figure 36. Dell Inc.: Net Sales, 2019-2023 ($Million)

Figure 37. Dell Inc.: Revenue Share, By Segment, 2030

Figure 38. Dell Inc.: Revenue Share, By Region, 2030

Figure 39. Trend Micro Incorporated: Net Sales, 2019-2023 ($Million)

Figure 40. Trend Micro Incorporated: Revenue Share, By Segment, 2030

Figure 41. Trend Micro Incorporated: Revenue Share, By Region, 2030

Figure 42. Cisco Systems: Net Sales, 2019-2023 ($Million)

Figure 43. Cisco Systems: Revenue Share, By Segment, 2030

Figure 44. Cisco Systems: Revenue Share, By Region, 2030

Figure 45. Imperva: Net Sales, 2019-2023 ($Million)

Figure 46. Imperva: Revenue Share, By Segment, 2030

Figure 47. Imperva: Revenue Share, By Region, 2030

Figure 48. Avg Technologies: Net Sales, 2019-2023 ($Million)

Figure 49. Avg Technologies: Revenue Share, By Segment, 2030

Figure 50. Avg Technologies: Revenue Share, By Region, 2030

Figure 51. F-Secure Corporation.: Net Sales, 2019-2023 ($Million)

Figure 52. F-Secure Corporation.: Revenue Share, By Segment, 2030

Figure 53. F-Secure Corporation.: Revenue Share, By Region, 2030

Figure 54. Panda Security: Net Sales, 2019-2023 ($Million)

Figure 55. Panda Security: Revenue Share, By Segment, 2030

Figure 56. Panda Security: Revenue Share, By Region, 2030

Select PDF License

Single User: $2000

Multiple Users: $3000

Corporate Users: $4000