India Paint Market Size, Trends Analysis Research Report by Technology (Water-based Coatings, Solvent-based Coatings, Powder Coatings, UV-cured Coatings), by Product Type (Decorative Paints, Industrial Paints), and by Resin Type, by End-User (Construction, Automotive, Aerospace, Marine, Electronics, Furniture and Woodworking), Region Global Market Analysis and Forecast, 2025-2034

Sep-2025 Formats | PDF | Category: Chemical | Delivery: 24 to 72 Hours

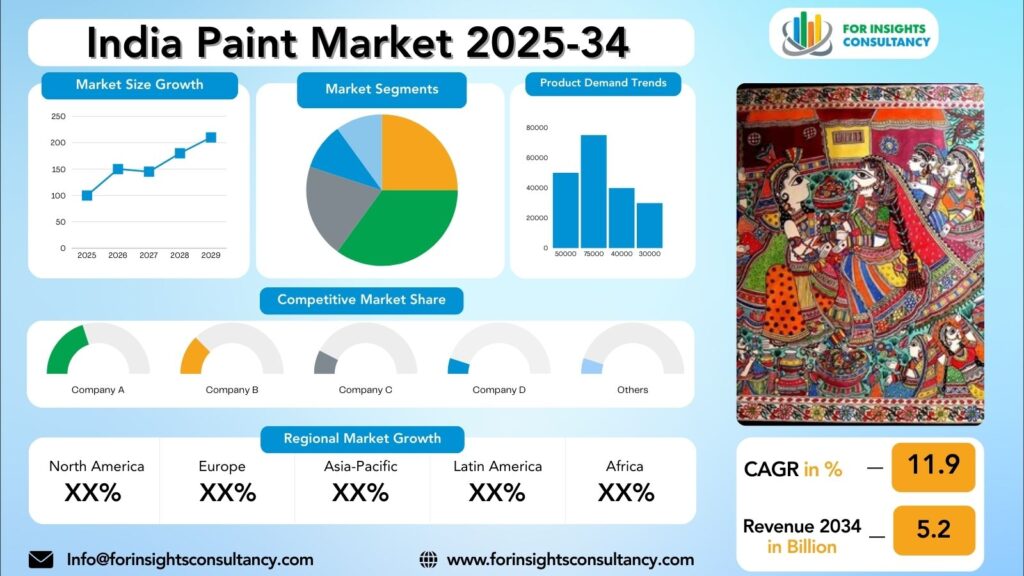

India Paint Market is forecast to increase from USD 7.8 Billion in 2025 to USD 11.9 Billion by 2034, at a CAGR of 5.2%.

India Paint Market: A Comprehensive Overviewand Future Developments

The India paint market is a significant player in the Asia-Pacific region, with domestic and international players competing for market share. The market is divided into decorative paints for beautification and industrial paints for industries like automotive, construction, and marine. The decorative paints segment is dominated by Asian Paints, Berger Paints, and Nerolac, with their wide range of products and brand loyalty. The industrial paints segment is driven by the booming automotive and construction industries in India, with companies like AkzoNobel, PPG Industries, and Sherwin-Williams catering to these industries with innovative paint solutions.

Key players in the India paint market include Asian Paints, Berger Paints, and Nerolac Paints. Asian Paints maintains its market dominance with its wide distribution network and innovative product offerings. Berger Paints is known for its high-quality products and customer-centric approach, while Nerolac Paints, a subsidiary of Kansai Paints, is known for its environmentally friendly products and commitment to sustainability.

The India paint market is expected to grow further due to factors like infrastructure development, rising disposable income, and the shift towards eco-friendly paints. Players are investing in research and development to introduce innovative products that cater to consumer needs.

India Paint Market Dynamics

Growth Drivers

India’s rapid urbanization has led to increased construction activities, both residential and commercial, driving the demand for paints and coatings. The Indian government’s focus on infrastructure development, such as the Smart Cities Mission and Affordable Housing Scheme, has fueled the paint market’s growth by constructing new urban centers, residential complexes, and public facilities that require significant amounts of paint and coatings. The rising disposable income among the middle-class population has also driven the paint market, as consumers are more inclined to invest in home renovation and beautification projects, leading to a surge in demand for premium and designer paints.

Technological advancements in the paint industry have led to the development of innovative and eco-friendly paint products, such as low-VOC and zero-VOC paints, which have gained traction among environmentally conscious consumers. Digital technology has revolutionized the paint selection process, allowing consumers to visualize paint colors and finishes before making a purchase.

The India paint market has seen a gradual shift towards the organized sector, with established players dominating the market share. Organized paint companies offer a wide range of products, including premium and customized solutions, catering to diverse consumer needs. This shift has resulted in better quality control, standardized pricing, and wider availability of paint products, enhancing consumer trust and driving market growth.

Restraints

The India paint market faces several challenges, including economic challenges due to fluctuating GDP growth and inflation rates, regulatory hurdles in compliance with environmental and safety standards, intense competition from domestic and international players, and supply chain disruptions. Consumers are becoming more cautious about their spending habits, which can impact the demand for paint products and decrease sales for companies.

Regulatory hurdles can lead to increased production costs and impacted pricing, making it difficult for companies to stay competitive. To stand out in this crowded market, companies need to focus on innovation and product differentiation to attract and retain customers.

Supply chain disruptions can also pose a significant restraint in the India paint market, as companies rely on a complex network of suppliers and distributors to bring their products to market. Any disruptions in this supply chain, such as natural disasters or political unrest, can impact the availability of paint products and lead to delays in delivery, affecting customer satisfaction and brand reputation.

In conclusion, while the India paint market offers growth opportunities, companies must navigate these challenges and implement strategies to position themselves for long-term success in this dynamic and evolving market.

Opportunities

The India paint market presents a promising opportunity for investors to capitalize on the growing demand for paints and coatings in the country. By expanding their product portfolio, embracing digitalization and e-commerce, and investing in research and development, companies can tap into diverse customer segments and maximize their revenue potential. By offering a wide range of colors, finishes, and specialty paints, companies can tap into different market segments and maximize their revenue potential.

Investing in digital marketing strategies and e-commerce platforms can also help businesses capitalize on the growing trend of online paint shopping. Investing in research and development can give companies a competitive edge by creating new and advanced paint formulations, attracting a loyal customer base, and boosting their market share.

However, investors should also be aware of the challenges associated with the industry, such as fluctuating raw material prices, intense competition, and changing consumer preferences. Thorough market research and robust strategies are essential for successful market entry.

In conclusion, the India paint market presents a lucrative opportunity for investors to capitalize on the growing demand for paints and coatings in the country.

Challenges

The India paint market faces several challenges, including rising raw material costs, changing consumer preferences, intense competition, and regulatory challenges. Rising costs of key components like pigments, resins, and solvents can impact profit margins and pricing strategies. Consumers are increasingly focused on sustainability and environmentally friendly products, necessitating the development of eco-friendly paint options. Intense competition between domestic and international players can lead to price wars and undercutting, impacting profitability. To survive, manufacturers must differentiate their products through branding, quality, and customer service.

Regulatory challenges, such as increasing government regulations on VOC emissions and hazardous materials, also pose a hurdle. Non-compliance can result in fines, lawsuits, and damage to the brand’s reputation. To overcome these obstacles, paint manufacturers can invest in research and development, differentiate their brand through quality, customer service, and branding, stay updated on environmental standards, diversify product offerings, and collaborate with suppliers to negotiate better pricing on raw materials. By adopting these strategies, they can navigate the challenges and thrive in the India paint market.

India Paint Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- Asian Paints

- Berger Paints India

- Kansai Nerolac Paints

- JSW Paints

- Indigo Paints

- Birla Opus

- Shalimar Paints

India Paint Market News

Asian Paints

Despite being the market leader in terms of revenue, Asian Paints faced a significant decline in net profit in FY 2024-25, dropping by over 32% year-on-year. This has been attributed to challenges like higher raw material costs, inflation, and increased competition.

Berger Paints India

Berger Paints has shown resilient performance despite the challenging market, with a slight increase in revenue and a 6.2% growth in profit after tax (PAT) in FY 2024-25. It has been successful in increasing its market share, reaching 20.3% in FY 2024-25. In July 2025, the company announced a final dividend of ₹3.80 per share for the financial year 2024-25.

JSW Paints & Akzo Nobel India (Dulux)

In June 2025, JSW Group’s JSW Paints signed an agreement to acquire Akzo Nobel India. This strategic move, valued at approximately €1.4 billion, will allow JSW to rapidly expand its presence and gain a significant share of the market, particularly with the acquisition of the globally renowned Dulux brand.

Kansai Nerolac Paints

Kansai Nerolac is actively engaged in corporate activities, including holding its 104th Annual General Meeting in June 2024 and entering into a loan agreement with its wholly-owned subsidiary, Nerofix.

Indigo Paints

Indigo Paints showed strong revenue growth, outperforming the major players in the first half of FY 2024-25. However, it experienced a decline in profit during the same period.

Segmented View of the Industry:

The Equipment segment holds the largest market share due to the high cost of terminals, antennas, and modems. However, the Connectivity Services segment is expected to show the highest growth rate.

The India Paint Market Is Mapped Through A Multidimensional Lens-Tracking Shifts Across Product Type, Applications, And Geographic Regions. This Segmented Approach Enables Businesses To Localize Their Growth Plans And Align Offerings With The Most Profitable Demand Centers.

Segmentation by Technology

- Water-based Coatings

- Solvent-based Coatings

- Powder Coatings

- UV-cured Coatings

Segmentation by Product Type

- Decorative Paints

- Industrial Paints

Segmentation by Resin Type

- Acrylic

- Epoxy

- Polyurethane

- Alkyd

- Polyester

Segmentation byEnd User

- Construction

- Automotive

- Aerospace

- Marine

- Electronics

- Furniture and Woodworking

Global Geographic Coverage:

Based on recent market analysis, North America is the largest and most mature market for Very Small Aperture Terminals (VSAT). Its leading position is driven by significant investments in defense and government sectors and a well-established telecommunications infrastructure.

The Report Provides In-Depth Qualitative and Quantitative Data On the India Paint Market For All Of The Regions And Countries Listed Below:

India

India’s paint market is experiencing a surge due to factors like urbanization, middle-class population growth, and disposable income. The construction industry is also driving demand, with new residential and commercial projects being developed. Indian consumers have a wide range of paint products, including eco-friendly options. Technological advancements in the paint industry have led to the development of innovative products like anti-bacterial paints, heat-reflective paints, and low-VOC paints. These innovations not only enhance the quality of paints but also cater to changing consumer needs and preferences.

North India

North India, with major cities like Delhi, Jaipur, and Lucknow, is a significant paint market due to its extreme weather conditions, necessitating the use of high-quality, durable paints that can withstand these harsh conditions.

South India

South India’s vibrant culture and rich heritage influence the paint market, with cities like Bangalore, Chennai, and Hyderabad being economic hubs, resulting in a steady demand for paints in residential and commercial projects.

East India

East India, with cities like Kolkata, Bhubaneswar, and Guwahati, has a diverse paint market due to its proximity to natural resources and industrial hubs.

West India

West India, including Mumbai, Pune, and Ahmedabad, is a significant player in the paint market due to its dynamic real estate sector and thriving industrial base. The demand for modern and sleek designs drives the industry’s diverse regional dynamics. Understanding these unique factors is crucial for businesses seeking to tap into the Indian paint market’s vast potential.

Reasons to Buy:

- The Research Would Help Top Administration/Policymakers/Professionals/Product Advancements/Sales Managers And Stakeholders In This Market In The Following Ways.

- The Report Provides India Paint Market Revenues At The Worldwide, Regional, And Country Levels With A Complete Analysis To 2034 Permitting Companies To Analyze Their Market Share And Analyze Projections, And Find New Markets To Aim For.

- To Understand The Most Affecting Driving And Restraining Forces In The Market And Their Impact On The Global Market.

- Major Changes And Assessment In Market Dynamics And Developments.

- The Objective Of The India Paint Market Report Is To Identify New Business Opportunities Using Quantitative Market Forecasts.

- Formulate Sales And Marketing Strategies By Gaining An Understanding Of Competitors, Their Positioning, And Strengths & Weaknesses.

Faq – What Global Leaders Are Asking

What Is The Growth Prospect For The India Paint Market By 2034?

India Paint Market Is Expected To Achieve A Stable Growth Rate With A Compound Annual Growth Rate (Cagr) Of About 5.2% From 2025 Through 2034.

What Is Driving The Growth Of The India Paint Market?

The India paint market’s growth is primarily driven by rapid urbanization and a booming real estate sector, which fuel demand for both new construction and repainting. Additionally, rising disposable incomes and government initiatives promoting housing and infrastructure projects are key growth catalysts.

Who Are The Key Players In The India Paint Market, And What Are Their Market Shares?

The India Paint Market Includes Major Companies Like Asian Paints, Berger Paints India, Kansai Nerolac Paints, JSW Paints, Indigo Paints, Birla Opus, Shalimar Paints, Others.

Specific Market Share Data Is Not Publicly Available and Is Typically Provided In Detailed, Proprietary Market Research Reports.

Which Regions Are Leading the India Paint Market Growth?

The Southern and Western regions are leading the growth of the Indian paint market, driven by high rates of urbanization and infrastructure development. States like Maharashtra, Gujarat, Tamil Nadu, and Karnataka are industrial and automotive hubs, which fuels demand for both decorative and industrial paints.

Customization: We Can Provide Following Things

1) On Market More Company Profiles (Competitors)

2) Data About Particular Country Or Region

3) We Will Incorporate The Same With No Additional Cost (Post Conducting Feasibility).

Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us/

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/