Indian Footwear Market Size, Trends Analysis Research Report by Product Type (Non-Athletic Footwear, Athletic Footwear), by Material (Leather, Non-Leather), and by End-User (Men's Footwear, Women's Footwear, Children's Footwear), by Pricing, and by Region Global Market Analysis and Forecast, 2025-2034

Sep-2025 Formats | PDF | Category: Consumer Goods | Delivery: 24 to 72 Hours

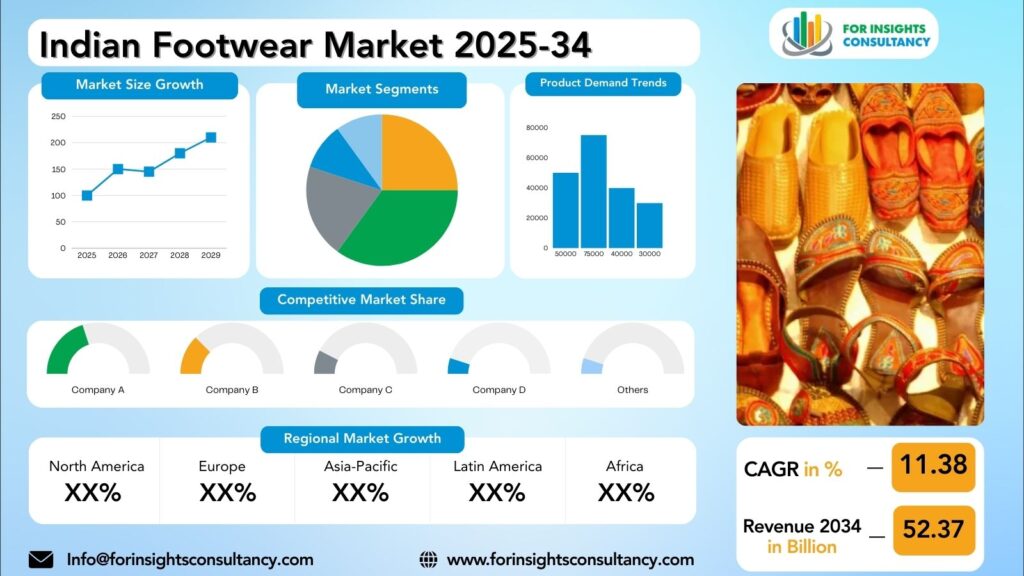

Indian Footwear Market is forecast to increase from USD 18.98 Billion in 2025 to USD 52.37 Billion by 2034, at a CAGR of 11.38%.

Indian Footwear Market: A Comprehensive Overview and Future Developments

The Indian footwear market is experiencing rapid growth due to the country’s booming economy and growing middle class. Manufacturers are investing in research and development to create innovative designs and materials that cater to consumer preferences. The Indian population’s rising disposable income has driven a surge in demand for high-quality, stylish, and durable footwear, resulting in a surge in the market for branded and premium options.

E-commerce is also playing a crucial role in driving growth, offering consumers a wide range of options and the convenience of shopping from home. This trend is expected to continue in the future. The Indian footwear market is poised for tremendous growth in the coming years, offering lucrative opportunities for both domestic and international players. By addressing challenges and focusing on quality and innovation, the Indian footwear industry can establish itself as a global leader in the footwear market.

Indian Footwear Market Dynamics

Growth Drivers

The Indian footwear market is experiencing growth due to changing consumer preferences, e-commerce boom, fashion and trends, and rapid urbanization. With a growing middle-class population and increasing disposable income, consumers are more willing to spend on premium and luxury footwear brands. This shift in consumer behavior has created opportunities for both domestic and international footwear companies to expand their product offerings and capture a larger market share.

The rise of e-commerce has revolutionized the way consumers shop for footwear in India, making it easier for them to browse and purchase a wide range of options from the comfort of their homes. Fashion and trends have also driven the market, with consumers becoming more fashion-conscious and seeking the latest styles and designs.

The rapid pace of urbanization in India has also played a significant role in driving the growth of the footwear market. As more people move to urban areas, the demand for footwear has increased, with urban consumers more likely to spend on premium and branded footwear.

The Indian government has implemented various initiatives to support the growth of the footwear industry, including favorable trade policies, incentives for domestic manufacturing, and efforts to promote the export of Indian footwear products.

Restraints

The Indian footwear market faces several challenges, including inadequate infrastructure, high manufacturing costs, fierce competition, and the presence of counterfeit products. Infrastructure issues include poor transportation facilities, inadequate warehousing, and inefficient distribution networks, which can lead to supply chain delays and lower profitability. High manufacturing costs include rising labor costs, raw material prices, and stringent regulatory requirements. The market is highly competitive, with both domestic and international brands vying for market share. To overcome these challenges, footwear companies can invest in technology and innovation, such as advanced supply chain management systems, automation, and data analytics for demand forecasting.

Opportunities for improving manufacturing processes include adopting lean manufacturing principles, improving resource utilization, and negotiating better deals with suppliers. By focusing on cost reduction strategies, manufacturers can maintain competitive pricing and improve profitability. Building a strong brand identity is crucial for attracting and retaining customers in a crowded market. Investing in branding efforts, such as compelling marketing campaigns, collaborating with influencers, and providing exceptional customer service, can differentiate footwear companies from competitors and build brand loyalty.

To combat counterfeit products, footwear companies can use measures like holographic labels, RFID tags, and QR codes to authenticate their products. Educating consumers about the dangers of counterfeit products and promoting authenticity and originality can also help build trust and loyalty among customers.

Opportunities

The Indian footwear market presents numerous opportunities for companies to cater to the growing fashion-conscious Indian population. With rapid urbanization and a growing middle-class population, there is a significant demand for trendy and affordable footwear. Companies can capitalize on this by offering stylish and affordable options for urban consumers. The e-commerce boom in India offers a significant opportunity for footwear companies to reach a wider audience and increase sales. Companies can differentiate themselves by offering eco-friendly footwear options made from recycled materials or sustainable production practices.

Tier II and III cities also present significant potential for footwear companies. As disposable incomes rise in these cities, consumers are looking for quality footwear options, presenting an opportunity for companies to expand their presence in these emerging markets. Incorporating new technologies and innovative designs in footwear can set companies apart in the competitive Indian market. From smart shoes with fitness tracking features to customizable shoe designs, there are endless possibilities for companies to innovate and capture the attention of Indian consumers. By understanding these preferences, companies can tailor their products to meet the needs of the Indian consumer and attract a larger share of the market.

Challenges

The Indian footwear market faces several challenges due to changing consumer preferences, pricing pressures, supply chain disruptions, and regulatory challenges. The rise of fast fashion and e-commerce has exposed consumers to new trends and styles, forcing footwear companies to stay ahead of the curve and innovate to meet their target audience. Consumers are becoming more conscious about sustainability and ethical practices, putting pressure on companies to adopt eco-friendly and socially responsible manufacturing processes.

Price pressures are another challenge, as companies often have to lower prices to stay competitive, impacting profit margins and limiting investment in research and development. Balancing competitive prices with profitability is crucial for long-term success in the Indian footwear market.

Supply chain disruptions, such as the COVID-19 pandemic, have become more common, impacting production and distribution of footwear products. Companies need robust supply chain management systems to mitigate these disruptions and meet customer demand promptly.

Regulatory challenges include compliance with quality standards and labor laws, ensuring safety and quality standards for products, adhering to labor laws, and providing a safe working environment for employees. Navigating the regulatory landscape can be complex, but it is essential for companies to operate ethically and sustainably.

Indian Footwear Market Top Companies Covered In This Report:

Evaluate The Strategic Positioning And Innovation Pipelines Of Leading Market Companies-From Multinational Enterprises To Disruptive Regional Firms. Understand How Key Players Are Innovating, Expanding, And Capturing Value, And Use Competitive Benchmarks To Plan Your Next Move.

- Relaxo

- Lakhani Footwear

- Liberty

- Ajanta Shoes

- Khadims

- Campus Activewear

- Nike India

- Bata India

- Paragon

- ACTION EVA FLOTTER

- Sreeleathers

- Catwalk

- Mochi

- Lallan Shoes

- DSK Leather Works

- Condor Footwear

- Dayz Footwear

- Adidas India

- Crocs India

- Puma Sports India

- Reebok India

- Hush Puppies

- Russo Brunello

- Da Milano

Indian Footwear Market News

Bata India

Bata, one of India’s most recognized brands, focused on operational efficiency and a premium product push. In its fiscal year 2025, the company reported a rise in net profit despite a slight dip in overall revenue, achieved through cost rationalization and a focus on volume-led growth in its premium segments. The company also reduced its workforce and trimmed salary hikes to manage expenses.

From a brand perspective, Bata is leveraging digital initiatives and refreshing its collections. News from early 2025 highlighted the brand’s use of generative AI on its e-commerce platform to enhance the online shopping experience. In 2024, it also launched a new global brand campaign, “Make Your Way,” to appeal to a younger, more style-conscious consumer base.

Relaxo Footwears

Relaxo, a leader in the mass-market and economy segments, faced challenges in 2025 with a decline in net sales and profit. The company’s financial report for FY25 showed that while it maintained a strong cash flow from operations, its operating profit and net profit margins decreased.

Despite the financial headwinds, the company is still a significant player. Its share price, along with other footwear stocks, saw a positive surge in late 2025 following a GST rate cut on shoes below ₹2,500. This government initiative is expected to boost demand, particularly in the semi-urban and rural markets where Relaxo has a strong presence.

Campus Activewear

Campus Activewear, a fast-growing brand in the athletic segment, reported strong financial results in the first half of 2025. The company’s net profit and sales rose significantly year-on-year, cementing its position as a major competitor to global players like Adidas and Puma.

The company’s success is attributed to its strategy of offering stylish and affordable sports and athleisure footwear that caters specifically to the Indian consumer. Its stock also benefited from the late 2025 GST rate reduction, as its core products fall within the affected price bracket.

Segmented View of the Industry:

The Equipment segment holds the largest market share due to the high cost of terminals, antennas, and modems. However, the Connectivity Services segment is expected to show the highest growth rate.

The Indian Footwear Market Is Mapped Through A Multidimensional Lens-Tracking Shifts Across Product Type, Applications, And Geographic Regions. This Segmented Approach Enables Businesses To Localize Their Growth Plans And Align Offerings With The Most Profitable Demand Centers.

Segmentation by Product Type

- Non-Athletic Footwear

- Athletic Footwear

Segmentation by Material

- Leather

- Non-Leather

Segmentation by End-User

- Men’s Footwear

- Women’s Footwear

- Children’s Footwear

Segmentation by Pricing

- Mass/Economy

- Mid-Range/Popular

- Premium

Global Geographic Coverage:

Based on recent market analysis, North America is the largest and most mature market for Very Small Aperture Terminals (VSAT). Its leading position is driven by significant investments in defense and government sectors and a well-established telecommunications infrastructure.

The Report Provides In-Depth Qualitative and Quantitative Data On the Indian Footwear Market For All Of The Regions And Countries Listed Below:

India

India’s footwear market is experiencing significant growth due to rising disposable incomes, changing fashion trends, and increasing foot health awareness.

The northern region is known for traditional footwear like mojaris and juttis, with major cities like Delhi and Jaipur being key hubs for manufacturing and retail. Southern India has a strong market for both traditional and contemporary styles, with states like Tamil Nadu and Kerala producing high-quality leather footwear.

The eastern region, characterized by its rich cultural heritage, has a growing consumer base for both traditional and modern footwear. West Bengal and Odisha are key manufacturing hubs for the industry, with several footwear clusters.

Western India, particularly Maharashtra and Gujarat, is a thriving market for footwear, with cities like Mumbai and Ahmedabad being fashion-conscious consumers. The western region also has a significant presence of international footwear brands catering to the diverse preferences of the population. By understanding regional dynamics and consumer preferences, businesses can effectively tap into this growing market.

Reasons to Buy:

- The Research Would Help Top Administration/Policymakers/Professionals/Product Advancements/Sales Managers And Stakeholders In This Market In The Following Ways.

- The Report Provides Indian Footwear Market Revenues At The Worldwide, Regional, And Country Levels With A Complete Analysis To 2034 Permitting Companies To Analyze Their Market Share And Analyze Projections, And Find New Markets To Aim For.

- To Understand The Most Affecting Driving And Restraining Forces In The Market And Their Impact On The Global Market.

- Major Changes And Assessment In Market Dynamics And Developments.

- The Objective Of The Indian Footwear Market Report Is To Identify New Business Opportunities Using Quantitative Market Forecasts.

- Formulate Sales And Marketing Strategies By Gaining An Understanding Of Competitors, Their Positioning, And Strengths & Weaknesses.

Faq – What Global Leaders Are Asking

What Is The Growth Prospect For The Indian Footwear Market By 2034?

Indian Footwear Market Is Expected To Achieve A Stable Growth Rate With A Compound Annual Growth Rate (Cagr) Of About 11.38% From 2025 Through 2034.

What Is Driving The Growth Of The Indian Footwear Market?

The growth of the Indian footwear market is driven by rising disposable incomes, rapid urbanization, and a growing consumer focus on health and fashion. These factors have led to increased demand for both affordable and branded athletic and non-athletic footwear.

Who Are The Key Players In The Indian Footwear Market, And What Are Their Market Shares?

The Indian Footwear Market Includes Major Companies Like Toyota Industries Corporation, Konecranes, JBT Corporation, Kuka Ag, Oceaneering International Inc., Murata Machinery Ltd., Addverb Technologies, Aichi Machine Industry Co. Ltd., Daifuku Group, Egemin Automation Inc., Others.

Specific Market Share Data Is Not Publicly Available and Is Typically Provided In Detailed, Proprietary Market Research Reports.

Which Regions Are Leading the Indian Footwear Market Growth?

Based on the information, the Asia-Pacific region is the fastest-growing market for Automated Guided Vehicles (AGVs), driven by strong industrial automation and the rapid expansion of the e-commerce sector. Key countries like China, India, and Japan are leading this growth with government initiatives and investments in smart manufacturing.

Customization: We Can Provide Following Things

1) On Market More Company Profiles (Competitors)

2) Data About Particular Country Or Region

3) We Will Incorporate The Same With No Additional Cost (Post Conducting Feasibility).

Any Requirement Contact Us: Https://Www.Forinsightsconsultancy.Com/Contact-Us/

Table of Contents

For TOC Contact us: https://forinsightsconsultancy.com/contact-us/