Pages: 300 | Jun-2024 Formats | PDF | Category: Consumer Goods | Delivery: 24 to 72 Hours

Cosmetic Market Research Summary

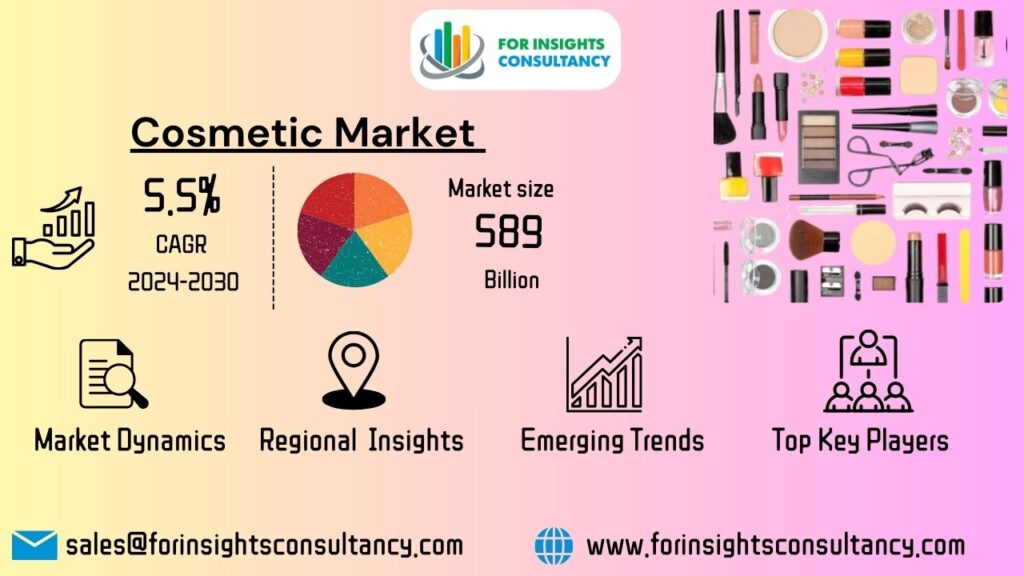

The cosmetic market is valued at

around US$ 401 billion in 2023. This market is forecasted to expand at a

compound annual growth rate (CAGR) of 5.5% to approximately US$ 589 billion by

2030.

The cosmetic market is an

animated business that embraces the broad range of products targeted at

beautifying humans and taking care of their personal hygiene. First, the

detailed report will glance at the current cosmetic market and then it will

delve into the upcoming changes that are affecting this industry.

With regard to the

Cosmetic market, one of the most influential factors is the increasing demand

of natural and organic products which in turn is the biggest cause of the

so-called clean Cosmetic movement that is a result of the consumers’ awareness.

In addition, there is a growing preference for eco-friendly packaging as well

as for products that have not been tested on animals.

On one side of the coin,

heavyweight cosmetic brands such as L’Oréal, Estée Lauder, and Procter &

Gamble are the leaders of the market because they dominate through the

innovation of their products and have a worldwide exploitation. At the same

time, the number of small indie brands that have gained popularity due to their

niche products and authentic brand stories is increasing.

The Cosmetic market is

going to be different from today as tomorrow technological breakthroughs will

provide the skincare industry with the products that will be able to address

the individual needs of the customers, virtual try-on tools, and the augmented

reality experience that will immerse the buyers in the shopping activity.

Besides, the rise of influencer collaborations and social media marketing will

greatly contribute to shaping consumer preferences and to creating sales in the

near future.

In short, the Cosmetic

industry is a vibrant and competitive one that keeps evolving in order to meet

the needs and wants of consumers who are different from time to time.

Cosmetic Market Dynamics

Cosmetic Market Trends for 2024-2025

Customers will primarily seek out

products that are good for the environment and are not subjected to animal

testing. This is likely to be a top concern for companies as they would have to

adopt environmentally friendly methods of production.

There will be an abundance of products that

adequately serve various skin tones and types, and therefore the beauty

industry will become more and more inclusive. Personalized skincare products

will be the next big thing, and tech will be the main facilitator.

Customers will be vigilant in selecting products

free from harmful chemicals or toxins, thus the demand for such products will

keep on rising leading to the launch of more clean beauty products. To make the

shopping experience more engaging and fun, brands will integrate more

technology with customers getting virtual try-ons, AI-based skin analysis, etc.

The beauty industry will see products which are not

just cosmetics but also come with wellness benefits like skincare

products infused with CBD and ingredients containing adaptogens. Brands

will have to adjust to the changing times brought about by Gen Z and meet their

demands for realness, inclusion, and environmental care if they want to survive

in the market.

Cosmetic Market Growth Drivers for 2024-2025

One of the leading factors to the

market expansion of cosmetics is the existence of natural and organic cosmetic

products as the buyers are gradually getting conscious of the sustainable and

eco-friendly alternatives. Innovations in beauty products like personalized

skincare and AI-powered cosmetics are only direct outcomes of the technological

advancements.

The adoption of beauty trends and the resulting

consumer preferences, which are mostly the impact of social media influencers

and celebrities, have been changed drastically. The beauty retail sector

through the net is getting higher, thus giving the work easier and a large

number of buyers worldwide.

The rise of disposable incomes and the change of

lifestyles can be counted as some of the reasons that have led to the demand increase

of premium and luxury cosmetic brands. Clean beauty products that do not

contain any harmful chemicals or ingredients have become popular as a reply to

the health and wellness trend.

Such factors are expected to fuel the cosmetic

market expansion over the forecast period.

Cosmetic Market Restraints for 2024-2025

The rising competition with new

entrants into the market may result in pricing pressures. The imposition of

strict regulations for product testing and approval may cause the procedure of

product launches to be longer.

The changes in the prices of raw materials may

result in a variation in profit margins. The turning of consumers to natural

and organic products may be a challenge for the existing cosmetic formulations.

On top of that, uncertainties in the economy and

changing consumer preferences can lead to slow market growth overall. The

influence of global events on supply chains, therefore, may be the cause of the

delay in the processes of manufacturing and distribution.

The company might have to invest heavily in

research and development during a period of fast technological changes. The

rise of sustainability and environmental concerns may be the reason for the

company to implement changes in the packaging and production processes.

The growing emphasis on personalization and

customization may require companies to adjust their product offerings to be

compatible. The move towards digital marketing and online sales channels may

create the need for traditional retailers to enhance their online presence.

Cosmetic Market Opportunities for 2024-2025

Clean beauty products in demand:

Consumers are consistently looking for natural and eco-friendly cosmetic

products.

Organic beauty shopping goes global: E-commerce

platforms provide a very convenient way for consumers to purchase cosmetics.

Rise of influencer marketing: Social media influencers extremely affect

cosmetic trends and consumer behavior.

Customization of beauty products: Beauty products

that are individually tailored are an ideal solution for the specific needs and

skin types of each person. The trend of wellness and self-care is growing:

Beauty products that make the user feel relaxed and take care of themselves are

becoming more popular.

Beauty industry goes green with packaging and

sustainability: The cosmetic industry is switching to eco-friendlier packaging

and refillable containers very quickly. Focus of pride on diversity and

inclusiveness: Companies use diversity in product development and marketing to

attract more customers.

Cosmetic Market Challenges for 2024-2025

More

Competition from New and Established Cosmetic Brands. Consumers are becoming

more conscious and demanding natural and environmentally friendly beauty

products.

Regulatory

changes that affect product development and marketing strategies. The consumer

is still moving towards environmentally friendly packaging and ingredients.

New beauty

tech trends such as AI-powered personalized skincare. Changing consumer

preferences and behaviors that are heavily influenced by social media and

influencers.

In order to

overcome these challenges successfully, cosmetic companies need to innovate, be

very quick in their adaptation and make customer engagement their number one

priority if they want to be able to retain their position in the continuously

changing market.

Cosmetic Market Segment Analysis

The cosmetics market is divided into several

categories that cater to the different needs and preferences of consumers.

Skincare: These products are such as moisturizers and cleansers which are aimed at

maintaining healthy skin and even improving it. With the increasing concerns of

aging skin, skin sensitivity, and pollution, skincare products have become a

trend for the last few years.

Makeup: In

makeup are included such products as foundation, lipsticks, mascaras,

eyeshadows, and blushes. Consumers do makeup to make themselves look more

attractive, to discover and present their creative side, and to be trendy. This

has led to an enormous market with a vast range of products.

Haircare: The

haircare products include shampoos and conditioners, styling products, and hair

treatments. They are the solutions to hair issues such as the hair being

damaged, frizzy, or dry. The demand for haircare products depends on hair

texture, hairstyling preferences, and hair health condition.

Fragrances: The

main sources of fragrances are perfumes, colognes, and body sprays. These

products are attractiveness to those consumers who want to display their scent

preferences. Besides that, they deliver a sensory experience. Fragrance fads

change with the seasons and culture.

Men’s Grooming: This segment comprises products such as shaving creams and aftershaves

that are used for men’s grooming. Also, facial cleansers, grooming tools, and

other grooming accessories are included here. The segment has been growing due

to the rising awareness of men’s personal grooming and their inclination

towards the specialized products.

Natural & Organic: This sector embraces products made entirely from natural ingredients

and those that do not contain synthetic chemicals. The need for such products

is a result of the consumers’ choice to live sustainably and make healthy

lifestyle decisions.

Brands can target and capitalize on specific consumer

preferences by targeting each segment of the cosmetics market.

By Category

- Skin & sun care products

- Hair care products

- Deodorants & fragrances

- Makeup & color cosmetics

By Gender

- Men

- Women

- Unisex

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Pharmacies

- Online Sales Channels

- Other

Competitive Landscape of the Cosmetic Market

Cosmetics market is highly competitive, with a wide

range of regional and global players competing to gain market share. The

industry is dominated by:

The cosmetic industry also features a number of

niche and independent brands that cater to consumer preferences and needs,

which contributes to its overall competitiveness. In this dynamic,

competitive environment, companies must be able to survive and thrive through

continuous innovation, strategic partnership, and effective marketing.

· Avon

Products

· Kao

Corporation

· Oriflame

Cosmetics S.A.

· Revlon Inc.

· Shiseido

Company Limited

· Skin Food

· Estee Lauder

Cosmetics Market Company News 2024 and 2025

Estee Lauder

In October

2024, Estée Lauder announced it would withdraw its 2025 annual sales and profit

forecast, and nearly halved its dividend, citing weak demand in China and Asia

travel retail.

In January

2025, the company confirmed that under its new CEO (effective 1 Jan 2025) it is

reviewing its portfolio of beauty brands and may sell some of them in an effort

to improve performance.

L’Oréal S.A

In June

2025, L’Oréal announced the acquisition of a majority stake in British skincare

brand Medik8 (valued ~€1 billion) to bolster its science-backed premium

skincare footprint.

Procter

& Gamble

For fiscal

year 2025, P&G reported net sales of US $20.9 billion in Q4 (up ~2% vs.

prior year), while its Beauty segment (skincare/hair etc.) saw organic growth

of ~1% in that quarter.

In January

2025, P&G said its Beauty segment organic sales were up ~2% year-on-year,

but volume was down; pricing and mix contributed to the growth.

Cosmetic Market Regional Outlook

The cosmetics market is dynamic in different

regions. It reflects the unique consumer preferences and influences of

socio-economic factors.

North America

The Cosmetic Market in North

America is expected to keep the trend of the growing volume. This will be made

possible by a GDP growth rate of 2.5% which is quite strong and an inflation

rate of 1.8% which is low. In Canada, local cosmetic brands have gained a

strong position in the market thanks to a government subsidy US, on the other

hand, a cultural shift towards clean beauty products has led to the increased

demand for sustainable and ethically sourced cosmetics.

Even though the main channel in North America is

still brick-and-mortar stores, online sales are the fastest-growing channel

through which customers take advantage of the transaction’s simplicity and

product’s diversity. Consumers in North America are looking for products that

meet the criteria of sustainability, ethical sourcing, and localism, which are

factors that must be considered by cosmetics brands if they want to be

successful in the market.

Although price and status are still influential in a

few emerging markets in North America, the transition to conscious consumerism

is becoming more dominant and, therefore, is driving the cosmetic industry’s

future in the region.

Europe

The Cosmetic Market in Europe is

predicted to keep expanding at a moderate pace due to a 2% GDP growth and a

1.5% inflation rate. In France, besides the general drivers, the local

government subsidies for eco-friendly and organic beauty products act as a main

factor to the development of the cosmetic industry there. While the main

channel for cosmetic products is still through traditional brick-and-mortar

stores, e-commerce is the fastest-growing channel, especially among younger

consumers. Sustainability and ethical sourcing are two factors that European

consumers cannot do without, and there is a growing preference for locally

sourced ingredients. However, in emerging markets where the price and status

are the most important factors, consumers are inclined to prioritize the

affordability and prestige of the brand ahead of the sustainability considerations.

Asia-Pacific

The GDP growth in the Cosmetic

Market in the Asia-Pacific region is forecasted to be 6.4% with an inflation

rate of 2.1%. A single local driver that distinctly impacts the market is the

trend of K-beauty in South Korea that is based on natural ingredient and

innovative formulations.

The main channel for cosmetic products to reach the

customers is through online platforms whereas the quickest expanding channel is

specialty beauty stores. The consumers apply in this region sustainability and

ethical sourcing as a condition of purchasing, thus, it is a must-have for

many. Nevertheless, in the case of emerging markets where price and status are

the main factors, consumers will be more concerned about the prestige that

comes with luxury cosmetic brands than the sustainability practices.

Middle East

and Africa

The cosmetic industry in the Middle

East and Africa is a profitable one. The region has a GDP growth rate of 3.5%

and an inflation rate of 2.1%. Sales of cosmetics in the UAE are mainly driven

by the Dubai Shopping Festival, which, by attracting tourists and locals,

creates a great beauty product purchasing spree. High-end department stores are

the predominant channel for cosmetics in the region, while e-commerce is the

fastest-growing channel due to its convenience and a wide product range.

Consumers in the Middle East and Africa are placing

more and more emphasis on sustainability and ethical sourcing as criteria for

selecting beauty products. Localism is also a very important trend, as a large

number of consumers are looking for products that are locally made and help the

community. In emerging markets where price and status are still the main

factors, affordable luxury products are becoming more popular as they provide a

compromise between quality and affordability.

Frequently

Asked Questions

How much is the cosmetics market size?

Cosmetic Market is expected to grow rapidly at a

5.5% CAGR consequently, it will grow from its existing size of from $ 401

Billion in 2023 to $ 589 Billion by 2030.

Who are the major players operating in the

cosmetics market?

The major market player includes Avon Products

Inc., Kao Corporation, L’Oreal S.A., Oriflame Cosmetics S.A., Revlon, Inc.,

Shiseido Company Limited, Skin Food Co., Ltd., The Estee Lauder Companies Inc.,

The Procter & Gamble Company and Unilever Plc..

Which are the driving factors of the cosmetics

market?

The surge in demand for organic cosmetics products

and the rapid growth in consumers disposable income are the growth driving

factors of the cosmetics market.

Which segment is expected to hold the largest share

in the cosmetics market?

The skin and sun care products held the largest

revenue share in the cosmetics market.

Report Features

This report gives the most complete information.

The report on Cosmetic Market format has been designed so that it can provide

the best value to the business. It offers crucial insights into the market’s

dynamic and will aid in strategic decision-making for current players as well

as those looking to join the market.

What Deliverables Will You Get in this Report?

|

Key questions this report answers |

Relevant contents in the report |

|

How big is the sales opportunity? |

In-depth analysis of the Global Cosmetic Market |

|

How lucrative is the future? |

Market forecast and trend data and emerging trends |

|

Which regions offer the best sales opportunities? |

Global, regional and country level historical data and forecasts |

|

Which are the most attractive Cosmetic market Key segments? |

Market segment analysis and forecast |

|

Which are the top Key players and their Cosmetic market positioning? |

Competitive landscape analysis, Market share analysis |

|

How complex is the business environment? |

Porter’s five forces analysis, PEST analysis, Life cycle analysis |

|

What are the factors affecting the Cosmetic market? |

Drivers & Restraints |

|

Will I get the information on my |

Customization: We Can Provide Following

Things 1) On Market More Company Profiles (Competitors) 2) Data About Particular Country Or Region 3) We Will Incorporate The Same With No Additional Cost (Post

Conducting Feasibility). Any Requirement Contact Us: https://www.Forinsightsconsultancy.Com/Contact-Us/ |

Table of Contents

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. Market Dynamics Analysis and Trends

5.1. Market Dynamics

5.1.1. Market Drivers

5.1.2. Market Restraints

5.1.3. Market Opportunities

5.2. Porter’s Five Forces Analysis

5.2.1. Bargaining power of suppliers

5.2.2. Bargaining power of buyers

5.2.3. Threat of substitute

5.2.4. Threat of new entrants

5.2.5. Degree of competition

Chapter 6. Competitive Landscape

6.1.1. Company Market Share/Positioning Analysis

6.1.2. Key Strategies Adopted by Players

6.1.3. Vendor Landscape

6.1.3.1. List of Suppliers

6.1.3.2. List of Buyers

Chapter 7. Global Cosmetics Market, By Category

7.1. Cosmetics Market, by Category Type, 2023-2030

7.1.1. Skin & sun care products

7.1.1.1. Market Revenue and Forecast (2018-2030)

7.1.2. Hair care products

7.1.2.1. Market Revenue and Forecast (2018-2030)

7.1.3. Deodorants & fragrances

7.1.3.1. Market Revenue and Forecast (2018-2030)

7.1.4. Makeup & color cosmetics

7.1.4.1. Market Revenue and Forecast (2018-2030)

Chapter 8. Global Cosmetics Market, By Gender

8.1. Cosmetics Market, by Gender, 2023-2030

8.1.1. Men

8.1.1.1. Market Revenue and Forecast (2018-2030)

8.1.2. Women

8.1.2.1. Market Revenue and Forecast (2018-2030)

8.1.3. Unisex

8.1.3.1. Market Revenue and Forecast (2018-2030)

Chapter 9. Global Cosmetics Market, By Distribution Channel

9.1. Cosmetics Market, by Distribution Channel, 2023-2030

9.1.1. Hypermarkets/Supermarkets

9.1.1.1. Market Revenue and Forecast (2018-2030)

9.1.2. Specialty Stores

9.1.2.1. Market Revenue and Forecast (2018-2030)

9.1.3. Pharmacies

9.1.3.1. Market Revenue and Forecast (2018-2030)

9.1.4. Online sales channels

9.1.4.1. Market Revenue and Forecast (2018-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2018-2030)

Chapter 10. Global Cosmetics Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Category (2018-2030)

10.1.2. Market Revenue and Forecast, by Gender (2018-2030)

10.1.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.1.4. U.S.

10.1.4.1. Market Revenue and Forecast, by Category (2018-2030)

10.1.4.2. Market Revenue and Forecast, by Gender (2018-2030)

10.1.4.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.1.5. Rest of North America

10.1.5.1. Market Revenue and Forecast, by Category (2018-2030)

10.1.5.2. Market Revenue and Forecast, by Gender (2018-2030)

10.1.5.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Category (2018-2030)

10.2.2. Market Revenue and Forecast, by Gender (2018-2030)

10.2.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.2.4. UK

10.2.4.1. Market Revenue and Forecast, by Category (2018-2030)

10.2.4.2. Market Revenue and Forecast, by Gender (2018-2030)

10.2.4.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.2.5. Germany

10.2.5.1. Market Revenue and Forecast, by Category (2018-2030)

10.2.5.2. Market Revenue and Forecast, by Gender (2018-2030)

10.2.5.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.2.6. France

10.2.6.1. Market Revenue and Forecast, by Category (2018-2030)

10.2.6.2. Market Revenue and Forecast, by Gender (2018-2030)

10.2.6.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.2.7. Rest of Europe

10.2.7.1. Market Revenue and Forecast, by Category (2018-2030)

10.2.7.2. Market Revenue and Forecast, by Gender (2018-2030)

10.2.7.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Category (2018-2030)

10.3.2. Market Revenue and Forecast, by Gender (2018-2030)

10.3.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.3.4. India

10.3.4.1. Market Revenue and Forecast, by Category (2018-2030)

10.3.4.2. Market Revenue and Forecast, by Gender (2018-2030)

10.3.4.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.3.5. China

10.3.5.1. Market Revenue and Forecast, by Category (2018-2030)

10.3.5.2. Market Revenue and Forecast, by Gender (2018-2030)

10.3.5.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.3.6. Japan

10.3.6.1. Market Revenue and Forecast, by Category (2018-2030)

10.3.6.2. Market Revenue and Forecast, by Gender (2018-2030)

10.3.6.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.3.7. Rest of APAC

10.3.7.1. Market Revenue and Forecast, by Category (2018-2030)

10.3.7.2. Market Revenue and Forecast, by Gender (2018-2030)

10.3.7.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Category (2018-2030)

10.4.2. Market Revenue and Forecast, by Gender (2018-2030)

10.4.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.4.4. GCC

10.4.4.1. Market Revenue and Forecast, by Category (2018-2030)

10.4.4.2. Market Revenue and Forecast, by Gender (2018-2030)

10.4.4.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.4.5. North Africa

10.4.5.1. Market Revenue and Forecast, by Category (2018-2030)

10.4.5.2. Market Revenue and Forecast, by Gender (2018-2030)

10.4.5.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.4.6. South Africa

10.4.6.1. Market Revenue and Forecast, by Category (2018-2030)

10.4.6.2. Market Revenue and Forecast, by Gender (2018-2030)

10.4.6.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.4.7. Rest of MEA

10.4.7.1. Market Revenue and Forecast, by Category (2018-2030)

10.4.7.2. Market Revenue and Forecast, by Gender (2018-2030)

10.4.7.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Category (2018-2030)

10.5.2. Market Revenue and Forecast, by Gender (2018-2030)

10.5.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.5.4. Brazil

10.5.4.1. Market Revenue and Forecast, by Category (2018-2030)

10.5.4.2. Market Revenue and Forecast, by Gender (2018-2030)

10.5.4.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

10.5.5. Rest of LATAM

10.5.5.1. Market Revenue and Forecast, by Category (2018-2030)

10.5.5.2. Market Revenue and Forecast, by Gender (2018-2030)

10.5.5.3. Market Revenue and Forecast, by Distribution Channel (2018-2030)

Chapter 11. Company Profiles

11.1. Avon Products Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Kao Corporation

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. L’Oreal S.A.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Oriflame Cosmetics S.A.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. Revlon, Inc.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Shiseido Company Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Skin Food Co., Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. The Estee Lauder Companies Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. The Procter & Gamble Company

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Unilever Plc.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Select PDF License

Single User: $3499

Multiple Users: $4499

Corporate Users: $5499